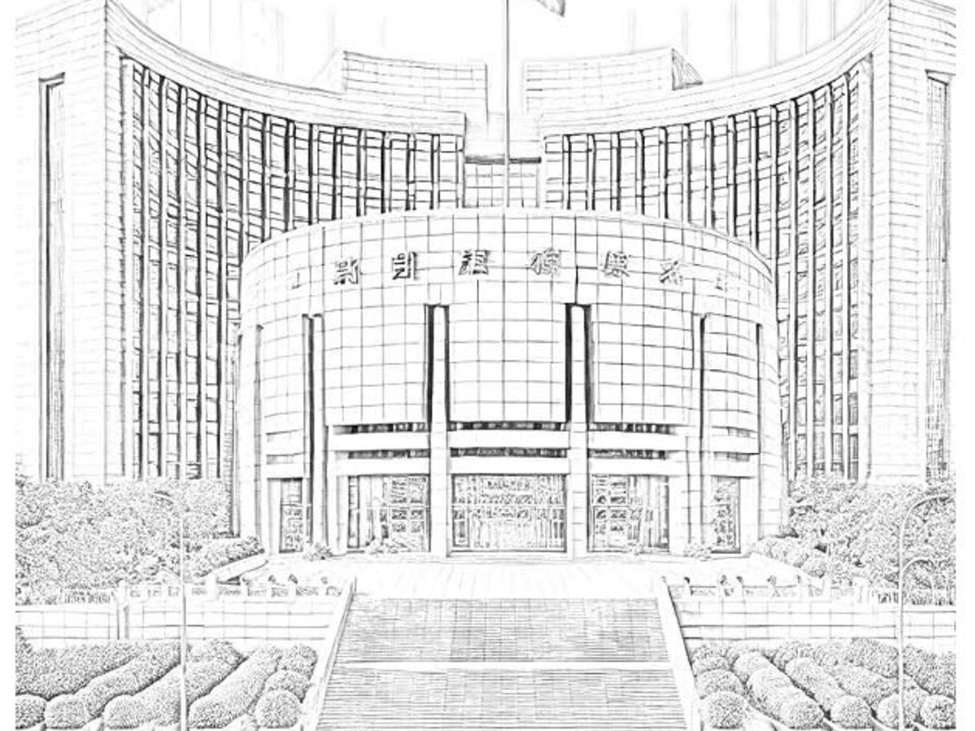

PBOC's Loan Prime Rates unchanged: 1 year 3%, 5 year 3.5%

People’s Bank of China rate setting:

- 5-year Loan Prime Rate at 3.50% vs 3.50% expected and 3.50% last month also

- 1-year at 3% vs. 3% expected and 3% last month too

In 2024, the People’s Bank of China (PBoC) implemented significant reforms to its monetary policy framework to enhance the effectiveness of its policy transmission and better support economic growth.

Traditionally, the PBoC utilized multiple policy rates, including the Medium-term Lending Facility (MLF) and Loan Prime Rate (LPR) rates, to influence market liquidity and interest rates. In June 2024, Governor Pan Gongsheng announced a strategic shift, designating the 7-day reverse repurchase (repo) rate as the primary short-term policy rate. This move aimed to streamline the monetary policy framework and improve the transmission of policy signals to the broader economy.

The 7-day reverse repo rate is pivotal in the PBoC’s open market operations, where it provides short-term liquidity to commercial banks. By focusing on this rate, the PBoC seeks to exert more direct influence over short-term market interest rates, thereby enhancing the responsiveness of financial institutions to policy changes.

The 7-day reverse repo rate is curently 1.4%

This article was written by Eamonn Sheridan at investinglive.com.