EUR/USD inches lower to near 1.1600 as traders adopt caution on US-EU trade uncertainty

- EUR/USD struggles as the US Dollar steadies amid market caution on expected US-EU trade developments.

- US Commerce Secretary Howard Lutnick expressed confidence that the US and EU will reach an agreement.

- The US Dollar may face challenges due to the rising dovish tone surrounding the Fed rate outlook.

EUR/USD edges lower after registering gains in the previous session, trading around 1.1620 during the Asian hours on Monday. The pair depreciates as the US Dollar (USD) holds steady, as traders adopt caution due to renewed trade tensions ahead of the US tariff deadline on August 1.

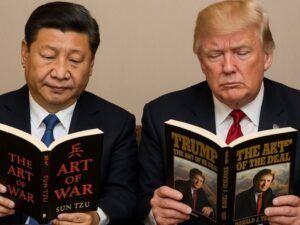

However, US Commerce Secretary Howard Lutnick expressed confidence that the Trump administration will secure trade deals with key US trading partners in the coming weeks before steep tariffs kick in for dozens of countries. “The next two weeks are going to be weeks for the record books. President Trump is going to deliver for the American people,” Lutnick said in an interview with CBS News.

Lutnick also expressed confidence that the United States (US) can reach a trade agreement with the European Union (EU), though he emphasized that August 1 remains a firm deadline before tariffs take effect. He mentioned that he had just spoken with European trade negotiators and believes there is “plenty of room” for compromise. “These are the two largest trading partners in the world in talks. We’ll get a deal done. I’m confident of that,” he said.

However, the downside of the EUR/USD pair could be restrained as the US Dollar (USD) may lose ground due to renewed sentiment for the Federal Reserve’s (Fed) rate cuts following dovish comments from the Fed officials.

Last week, San Francisco Fed President Mary Daly said that expecting two rate cuts this year is a “reasonable” outlook, while warning against waiting too long. Daly added that rates will eventually settle at 3% or higher, which is higher than the pre-pandemic neutral rate.

Fed Governor Christopher Waller also said that the labor market is doing fine overall, but less so in the private sector. The Fed should reduce its interest rate target at the July meeting, citing mounting economic risks, Waller added.

Euro FAQs

The Euro is the currency for the 19 European Union countries that belong to the Eurozone. It is the second most heavily traded currency in the world behind the US Dollar. In 2022, it accounted for 31% of all foreign exchange transactions, with an average daily turnover of over $2.2 trillion a day.

EUR/USD is the most heavily traded currency pair in the world, accounting for an estimated 30% off all transactions, followed by EUR/JPY (4%), EUR/GBP (3%) and EUR/AUD (2%).

The European Central Bank (ECB) in Frankfurt, Germany, is the reserve bank for the Eurozone. The ECB sets interest rates and manages monetary policy.

The ECB’s primary mandate is to maintain price stability, which means either controlling inflation or stimulating growth. Its primary tool is the raising or lowering of interest rates. Relatively high interest rates – or the expectation of higher rates – will usually benefit the Euro and vice versa.

The ECB Governing Council makes monetary policy decisions at meetings held eight times a year. Decisions are made by heads of the Eurozone national banks and six permanent members, including the President of the ECB, Christine Lagarde.

Eurozone inflation data, measured by the Harmonized Index of Consumer Prices (HICP), is an important econometric for the Euro. If inflation rises more than expected, especially if above the ECB’s 2% target, it obliges the ECB to raise interest rates to bring it back under control.

Relatively high interest rates compared to its counterparts will usually benefit the Euro, as it makes the region more attractive as a place for global investors to park their money.

Data releases gauge the health of the economy and can impact on the Euro. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the single currency.

A strong economy is good for the Euro. Not only does it attract more foreign investment but it may encourage the ECB to put up interest rates, which will directly strengthen the Euro. Otherwise, if economic data is weak, the Euro is likely to fall.

Economic data for the four largest economies in the euro area (Germany, France, Italy and Spain) are especially significant, as they account for 75% of the Eurozone’s economy.

Another significant data release for the Euro is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period.

If a country produces highly sought after exports then its currency will gain in value purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.