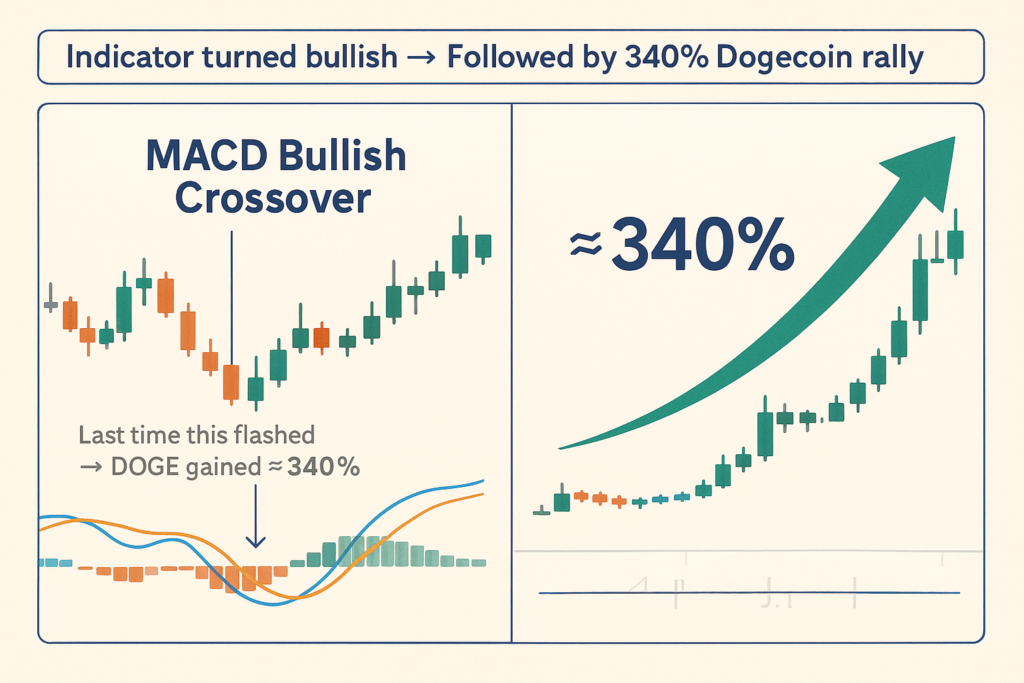

DOGE price gained 340% the last time this indicator turned bullish

DOGE’s Past Bullish Signal Sparked Over 300% Rally — Is History About to Repeat Itself?

In the constantly evolving world of cryptocurrencies, where sentiment often moves faster than fundamentals, experienced investors and traders are always on the lookout for recurring technical patterns. Identifying historically reliable indicators can offer a crucial edge in navigating the often volatile market waters. Dogecoin (DOGE), one of the most talked about “meme coins” in the sphere, is once again attracting attention with a technical indicator that previously preceded an extraordinary price surge.

Back in April 2021, DOGE experienced a sizeable upward move—surging over 340% in value—fueled in part by the emergence of a powerful technical setup: the golden cross. Now, in mid-2024, Dogecoin is flashing this same pattern on its charts, leading many to speculate that a similar rally might be in the making. Let’s explore what the golden cross means for DOGE, how it has played out in the past, and the conditions under which it could trigger another major rally.

Understanding the Golden Cross: Why Traders Watch It Closely

The term “golden cross” refers to a bullish chart pattern that occurs when a short-term moving average, commonly the 50-day MA, crosses above a longer-term moving average, usually the 200-day MA. This crossover signals a potential shift in trend direction from bearish to bullish. For technical analysts, this formation often serves as a robust buy signal, especially when confirmed by increasing volume and other supportive indicators.

In high-volatility environments like the crypto space, patterns such as the golden cross serve as a rare beacon of structure and predictability. Although not foolproof, they often highlight periods of renewed momentum and shifting investor sentiment. Successful traders don’t rely solely on these indicators, but when a historically accurate pattern flashes again—especially on a globally recognized token like Dogecoin—it can warrant a closer look.

Revisiting DOGE’s 2021 Golden Cross and Rally

During the bull market of early 2021, Dogecoin’s price action went from being a joke to a juggernaut overnight. While celebrity endorsements—most notably from Elon Musk—played a key role in driving awareness, many technical analysts noticed the signs weeks before the explosive rally truly began.

When the 50-day moving average crossed above the 200-day moving average in April 2021, a textbook golden cross was confirmed. Shortly after, DOGE catapulted from under $0.06 to a high just above $0.65 in a matter of weeks—marking one of the largest short-term rallies in altcoin history, a more than 340% increase. Crucially, this wasn’t just about hype. Smart money and technical traders alike were observing the signals and positioning themselves accordingly.

July 2024: A Familiar Pattern Reappears

Fast forward to July 2024. Once again, Dogecoin’s daily chart is showing strong indications of a golden cross, stirring excitement and cautious optimism across technical trading forums and crypto-focused news sources. Although broader macroeconomic conditions differ from 2021—particularly with higher interest rates and continued regulatory uncertainty—chart-based signals can operate independently of external noise, especially in sentiment-driven assets like DOGE.

Additional market data supports the validity of this crossover: on-chain metrics show increasing activity from mid-sized wallets accumulating DOGE, transaction volumes are climbing, and price support appears to be forming near long-term trendlines. These factors suggest heightened investor interest and a potential shift in DOGE’s momentum profile.

Furthermore, Dogecoin’s vibrant community and its integration into various tipping and payment platforms continue to maintain its visibility and liquidity—two key factors needed to fuel any significant breakout.

Other Historical Golden Cross Events for DOGE

While the 2021 event is the most memorable, it’s not the only instance where a golden cross has signaled bullish potential for Dogecoin. Let’s take a closer look at similar past occurrences:

- July 2020: This earlier golden cross paved the way for a nearly 270% rally over the subsequent weeks. While the breakout wasn’t as dramatic as the 2021 cycle, those positioned early were well rewarded.

- January 2018: Amidst a broader market correction, a temporary golden cross emerged, resulting in a 75% uptick before the overall bear market reasserted control. Despite the challenging backdrop, the signal still presented a short-term trading opportunity.

These historical comparisons demonstrate a pattern: while not every golden cross guarantees fireworks, the probability of a material price movement—especially in speculative assets with strong community engagement—remains significantly elevated following their appearance.

Market Conditions: Then vs. Now

It’s important to consider the broader context. In 2021, crypto markets benefited from unprecedented retail enthusiasm, easy access to capital, and widespread media hype. The current environment is more measured, with tighter monetary policy and increased regulatory scrutiny—factors which can temper explosive rallies.

However, crypto has matured in several key areas. Institutional participation has grown, infrastructure is more robust, and investor awareness is higher—even when it comes to meme coins. A golden cross in this evolved maturity phase may not yield a 340% breakout, but it could still represent a substantial upside opportunity, particularly for swing traders and high-conviction holders.

Sentiment and Social Influence Still Play a Role

Dogecoin’s price performance is deeply intertwined with social sentiment. Tweets, memes, and viral posts have historically had a meaningful impact on its momentum. That hasn’t changed. While technical indicators like the golden cross provide a framework for positioning, potential catalysts—such as renewed celebrity endorsements or major platform listings—could act as rocket fuel.

Moreover, Dogecoin remains one of the few cryptocurrencies with name recognition beyond the core crypto audience. That quasi-mainstream appeal, paired with technical signals and improved infrastructure integrations (e.g., support on Binance Pay, Coinbase Wallet, and various tipping bots), gives it a unique edge in the altcoin landscape.

Trading Takeaway: Technical Analysis Is a Tool, Not a Crystal Ball

Veteran traders know that no indicator is fail-proof. However, the golden cross is prized not just for its simplicity, but for its statistical relevance across multiple markets and timeframes.

In a space increasingly influenced by macro trends and short-term headlines, technical indicators offer a reality check—a quantitative approach to decision-making. Paired with risk management strategies, tools like the golden cross can help investors develop a roadmap instead of relying purely on market noise.

Conclusion: Golden Cross Might Be DOGE’s Signal Worth Watching

Dogecoin may still draw skepticism in financial circles, often laughed off as a joke token with limited utility. But time and again, it has demonstrated that technical patterns matter—and those who spot the signs early are often rewarded handsomely.

The golden cross currently forming on DOGE’s chart is not a guaranteed map to triple-digit gains. Yet, given its historical accuracy and supporting on-chain activity, this development warrants attention from traders and investors seeking high-risk/high-reward opportunities.

Whether or not history repeats itself exactly, the conditions suggest that something meaningful could be on the horizon for Dogecoin. In a world where timing can be everything, the return of this familiar signal may be the clue contrarian investors have been waiting for.