Franc Becomes Best Safe-Haven on Forex. Forecast as of 10.09.2025

Political crises in France and Japan are forcing investors to look for safe havens. The Swiss franc appears to be the best asset on Forex. Let’s discuss this topic and make a trading plan for the USDCHF pair.

The article covers the following subjects:

Major Takeaways

- The US dollar has lost its safe-haven status.

- The yen is hampered by the political crisis.

- The SNB will not cut rates in September.

- Short trades on the USDCHF pair can be opened at 0.8035.

Weekly Fundamental Forecast for Franc

Geopolitical tensions are escalating in various regions. Therefore, investors seek opportunities that offer both stability and potential for growth. Gold, Treasury bond yields, the US dollar, the Japanese yen, and the Swiss franc are generally considered safe-haven assets. Against this backdrop, precious metals are hitting new all-time highs, while Treasury yields have reached their lowest levels since 2022. In the global currency market, the Swiss franc is well-positioned to compete with other major currencies.

The US dollar is often considered the currency of pessimists. In times of market turmoil, the USD index is a popular investment destination. According to the latest data on the S&P 500 index, the US stock market is thriving. Meanwhile, the US administration’s efforts to control the Fed and the Bureau of Labor Statistics have led to investors viewing the greenback with a degree of skepticism, perceiving it as a less stable currency.

The yen could potentially assume this role; however, the ongoing political crisis in Japan and the Bank of Japan’s reluctance to take action are causing investors to question its reliability. The resignation of Prime Minister Shigeru Ishiba heightens the likelihood of further fiscal stimulus and government pressure on the central bank to normalize monetary policy gradually.

Spread Between Italian and French 10-Year Yields

Source: Bloomberg.

The franc is widely regarded as the leading safe-haven currency in the Forex market. It is traditionally used as a refuge amid heightened political risks in Europe. In this regard, France’s fourth government in just over a year is spurring demand for the Swiss franc. For the first time in history, yields on French bonds have exceeded those of their Italian counterparts, following Marine Le Pen’s statement that Emmanuel Macron’s choice of Sébastien Lecornu as the new prime minister marked his last move, making parliamentary elections unavoidable.

The strengthening of the franc poses a challenge for the National Bank. Coupled with the US’s 39% tariffs, this is causing Swiss exports to face significant headwinds. As a result, the country may suffer from resurfacing deflation, which it has been attempting to overcome.

SNB Policy Rate

Source: Bloomberg.

Currency interventions or a reduction in the key rate could remedy the current situation. However, neither of these options is suitable for the SNB. The central bank has ceased to intervene in the Forex market to avoid exacerbating tensions with the United States. The country is likely to be designated as a currency manipulator, which will likely result in increased tariffs.

According to SNB head Martin Schlegel, negative rates have numerous side effects, and the central bank will unlikely return to them. As a result, investors expect that in September, the SNB will maintain borrowing costs at the current zero level. In this connection, the Swiss franc strengthened significantly.

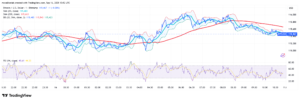

Weekly USDCHF Trading Plan

High demand for safe-haven assets and the Swiss National Bank’s reluctance to change its rate policy amid the Fed’s intention to cut rates give a strong sell signal for the USDCHF pair. Short trades formed at 0.805 can be kept open and increased on pullbacks.

This forecast is based on the analysis of fundamental factors, including official statements from financial institutions and regulators, various geopolitical and economic developments, and statistical data. Historical market data are also considered.

Price chart of USDCHF in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance broker. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2014/65/EU.

According to copyright law, this article is considered intellectual property, which includes a prohibition on copying and distributing it without consent.