Peter Schiff Warns Bitcoin Is “Topping Out” Ahead of Fed Rate Cuts

Is Bitcoin critic Peter Schiff finally going to be right for the first time in 16 years about Fed rate cuts? If you say the sky is falling until it happens, then you will say “See, I called it!!” just like Schiff.

Schiff took to X (formerly Twitter) to argue that BTC may be “topping out” instead of preparing for a breakout.

The Fed is about to make a major policy mistake by cutting interest rates into rising inflation. Gold and silver have broken out, with the rally finally confirmed by mining stocks leading the way. Yet instead of breaking out, Bitcoin is topping out. Time to change horses HODLers.

— Peter Schiff (@PeterSchiff) September 14, 2025

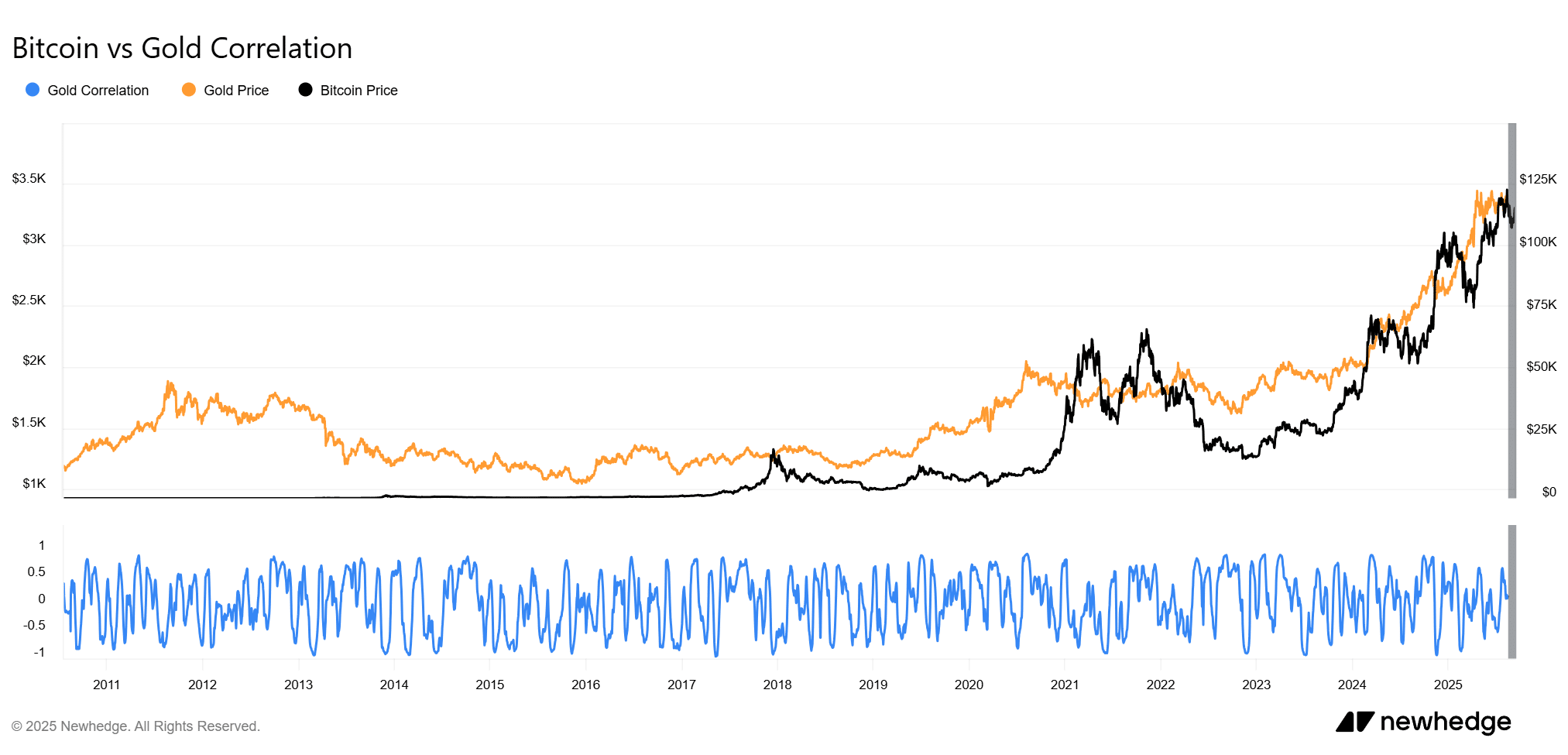

Schiff emphasized that Bitcoin remains 15% below its 2021 peak when priced in gold, a sign, in his view, that the asset lacks momentum compared to traditional hedges.

Is Peter Schiff Right That Fed Rate Cuts Won’t Matter For Bitcoin?

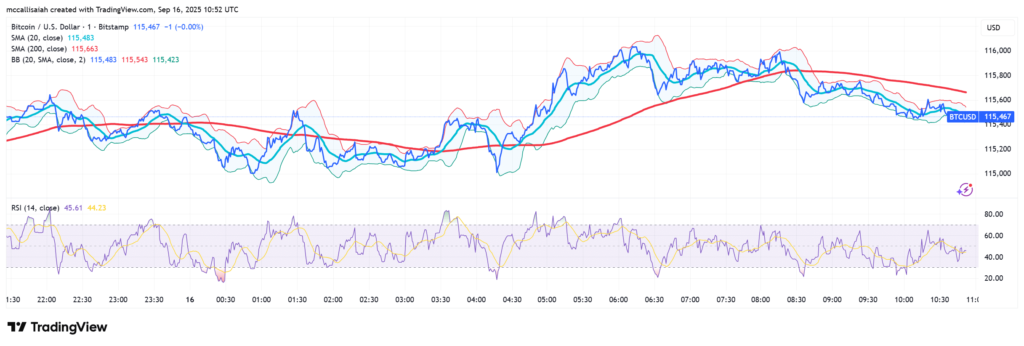

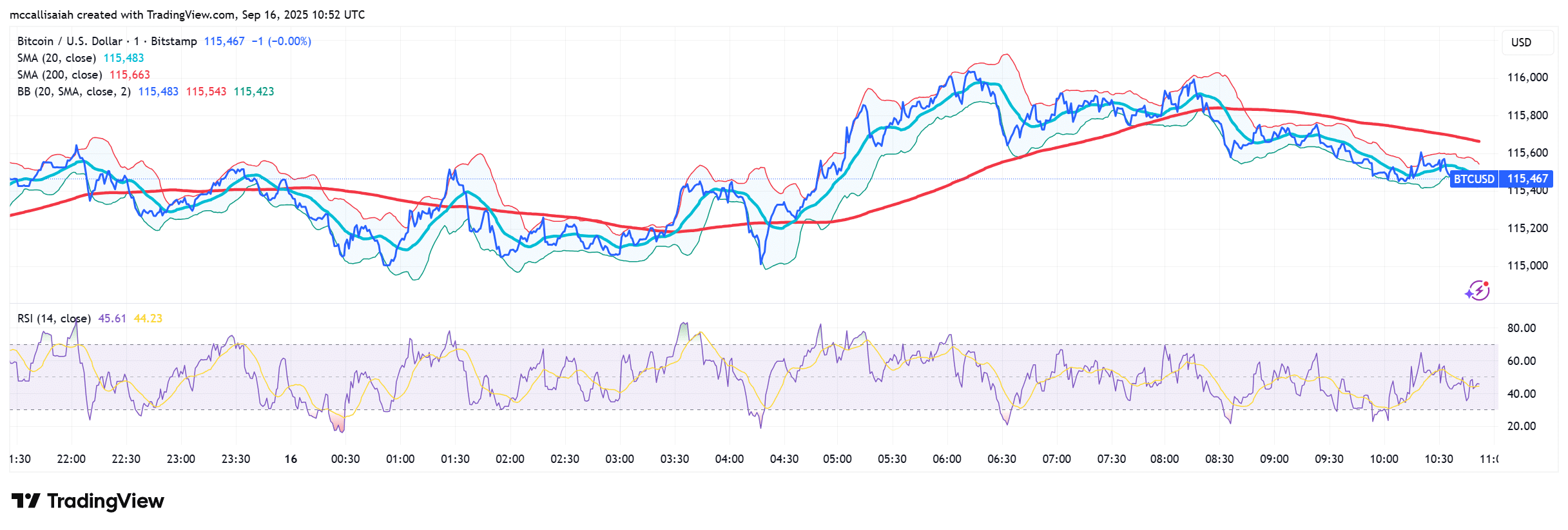

Bitcoin faces near-term selling pressure ahead of the Federal Reserve’s September 17 meeting, where a 25 basis point rate cut is broadly expected. The jury is out on whether the move is priced in, yet traders see the decision as a potential inflection point for risk assets.

BTC is holding near $115,400 after failing to break through $116,000 resistance.

Peter Schiff Warns of a Bitcoin Top: Why Are Gold, Silver, and Equities Shining While Bitcoin Stalls?

The divergence is clear: while the NASDAQ and S&P 500 hover at record highs and gold pushes through new breakouts, Bitcoin has struggled to sustain rallies. The Bitcoin/Gold ratio sits near 31.53 XAU, down 0.87%, underscoring Schiff’s point about lagging performance.

Yet not everyone agrees.

“I agree with you on Fed policy mistake. But you underestimate Bitcoin… It will most likely break out and make a lot bigger gains than gold and silver.” – Crypto investor reply on X.

Schiff pushed back, countering that if this were “just consolidation,” Bitcoin should already have broken out.

Can Bitcoin Break $116K Resistance?

Futures positioning has turned slightly positive, with CoinGlass reporting new inflows into Bitcoin derivatives ahead of the FOMC. Spot flows, however, remain negative as selling pressure dominates.

While Schiff’s warnings dominate headlines, other analysts remain firmly bullish. Kraken’s Dan Held noted that long-term demand dynamics favor upside, while market commentator Ted Pillows highlighted Bitcoin’s supply-demand imbalance:

Rate cuts are generally bearish in the short term.

This is because the Fed usually cuts rates when the economy is in some turmoil.

Just take a look at US stock indices after 3 months of the first rate cut.

S&P 500: Flat

Nasdaq: Barely positive

Russell 1000 and Russell 2000:… pic.twitter.com/en9hNubWML

— Ted (@TedPillows) September 14, 2025

99Bitcoins analysts argue Bitcoin must reclaim $114K as solid support to set up a sustained push toward $117K and beyond. Failure to do so risks trapping BTC in a sideways channel between $110K and $115K until the Fed delivers clearer forward guidance.

With the September rate cut almost guaranteed, Powell’s tone will be the real catalyst. A dovish outlook could spark the breakout Schiff insists won’t come.

EXPLORE: ETH USD Price Primed to Retest $4,700: Dark Money Rotating into Ethereum?

Join The 99Bitcoins News Discord Here For The Latest Market Updates

Key Takeaways

- Is Bitcoin critic Peter Schiff finally going to be right for the first time in 16 years about Fed rate cuts?

- Schiff pushed back, countering that if this were “just consolidation,” Bitcoin should already have broken out.

The post Peter Schiff Warns Bitcoin Is “Topping Out” Ahead of Fed Rate Cuts appeared first on 99Bitcoins.