China resists Fed easing, holds 1.40% rate as exports and stocks buoy outlook

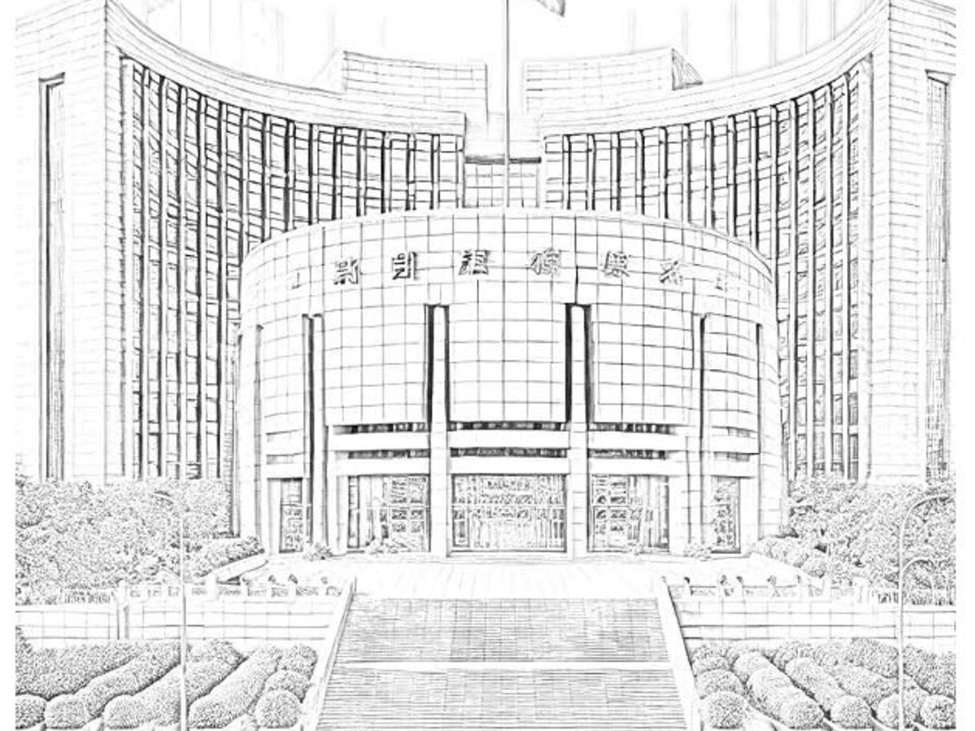

China’s central bank, the People’s Bank of China, left its key seven-day reverse repo rate unchanged at 1.40% on Thursday, signalling no urgency to ease policy even after the U.S. Federal Reserve cut rates hours earlier.

Analysts say resilient exports and a surging stock market near decade highs have given Beijing space to hold fire despite a slowing economy. Goldman Sachs economist Hui Shan noted that August data showed the downturn was less severe than expected, with authorities potentially deferring some stimulus to next year.

- Nomura’s Ting Lu cautioned that major easing could fuel a stock bubble, though a modest 10bp cut remains possible if markets correct.

- Other analysts expect policy support later this year to safeguard China’s growth target of “around 5%.”

- ANZ’s Xing Zhaopeng said further measures may come in Q4, but longer-term structural reforms under the upcoming October plenum remain a priority.