Nikkei 225 Outperforms US Indices As Takaichi Trade Thrives in Japan. Forecast as of 27.10.2025

While Japan’s Nikkei 225 index lagged behind its counterparts in the first half of the year, the change of prime minister and the Takaichi trade turned it from an ugly duckling into a beautiful swan. Let’s discuss this topic and make a trading plan.

The article covers the following subjects:

Major Takeaways

- The S&P 500 depends on a handful of companies.

- Global stock indices are outperforming the US indices.

- The Takaichi trade is helping Japanese stocks.

- The Nikkei 225 index can be purchased with targets of 50,700 and 52,600.

Weekly Fundamental Forecast for Nikkei 225

The bull market in US stocks has been underway for more than three years. However, the higher the S&P 500 index climbs, the more doubts emerge. Investors understand that the rally is based on AI. Companies are spending trillions of dollars on artificial intelligence, but the returns are not as high as they would like. Coupled with the uncertainty surrounding Donald Trump’s policies and fears of a slowdown in the US economy, investors are forced to diversify their portfolios.

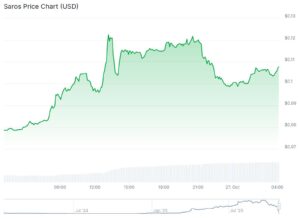

While the S&P 500 index has risen 15% since the beginning of the year, the MSCI All Country World ex USA has gained 26%. The South Korean Kospi (+64%), German DAX (+22%), and Japanese Nikkei 225 (+24%) indices have shown impressive growth. The latter stock index started the year among the underdogs, but the change of the country’s prime minister has helped it.

Stock Indices’ Performance

Source: Wall Street Journal.

Sanae Takaichi is a proponent of fiscal stimulus. She had previously stated that raising the overnight rate was unwise, but now asks that this statement be forgotten. The Japanese government maintains a policy of non-interference in the operations of the central bank. This is particularly noteworthy given that the Bank of Japan is led by Kazuo Ueda, a proponent of an accommodative monetary policy. Investors are cautious of such rhetoric. Will the new prime minister reconsider her position if the cycle of monetary tightening resumes?

Consequently, the Takaichi trade is gaining traction in Japan. Investors purchase stocks and sell the yen. For export-oriented corporations, devaluation can be a beneficial factor. For investors, it becomes a bullish factor. The recent improvement in relations between Washington and Tokyo, increased trade certainty, export growth, and fiscal stimulus may boost the country’s GDP, creating a favorable environment for the Nikkei 225 index.

P/E Ratio of Stock Indices

Source: Wall Street Journal.

The IMF has provided a modest forecast for Japan’s economy, expecting growth of just 0.2% in 2025. For comparison, the US GDP estimate is 1.9%. Low expectations typically result in a stock market rally if the economy manages to exceed them. Coupled with the lower valuation of Japanese stocks compared to US stocks, this is a compelling reason to buy the Nikkei 225 index. The price-to-earnings ratio for its companies is 21. The P/E ratio for the S&P 500 stands at 23.

Weekly Nikkei 225 Trading Plan

The rally in the Japanese stock market will likely continue, facilitated by fiscal stimulus and low interest rates, as well as better fundamental assessments and faster economic growth than forecast. Long positions on the Nikkei 225 formed on a pullback to 46,000 can be kept open and increased periodically. The first of the two previously set targets at 50,700 and 52,600 has almost been reached. The second target is in sight.

This forecast is based on the analysis of fundamental factors, including official statements from financial institutions and regulators, various geopolitical and economic developments, and statistical data. Historical market data are also considered.

Price chart of NI225 in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance broker. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2014/65/EU.

According to copyright law, this article is considered intellectual property, which includes a prohibition on copying and distributing it without consent.