Bitfinex Alpha | Volatility Incoming

28 Oct Bitfinex Alpha | Volatility Incoming

in Bitfinex Alpha

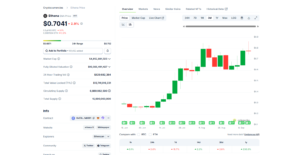

Driven by a potent mix of geopolitical uncertainty, macroeconomic factors, and the intensifying “Trump trade” narrative, BTC volatility has intensified, seeing a sharp 6.2 percent intra-week correction last week before rebounding. This pullback highlights the growing influence of the impending US presidential election on near-term prices, where a Republican victory is widely seen as bullish for risk assets like Bitcoin. The correlation between Trump’s election odds and Bitcoin’s upward trajectory has increased.

The anticipation around the election has fuelled a surge in options activity. Options expiring on key dates around the election are commanding higher premiums, with implied volatility expected to peak at 100 daily vol on November 8th, just after Election Day – indicating that the market is bracing for potential turbulence. Regardless of the election outcome, short-term volatility is expected to be higher than usual though we remain confident in longer-term price appreciation.

Despite recent corrections, Bitcoin has demonstrated remarkable resilience since its September dip to $52,756, rallying 30 percent through October. Seasonality is also on Bitcoin’s side: Q4 has been consistently bullish in halving years, with a median quarterly return of 31.34 percent. This strong seasonality effect, combined with record-breaking open interest in Bitcoin options and futures, underscores the optimism among market participants heading into the final stretch of the year.

Supporting this optimism is the steady build-up in call options for December 27th expiries, with a particular focus on $80,000 strikes. As options open interest climbs to new highs, the market is showing signs of positioning for a post-election surge, potentially propelling Bitcoin towards—and beyond—its all-time high of $73,666.

In summary, the convergence of election uncertainty, the “Trump trade” narrative, and favourable Q4 seasonality create a perfect storm for Bitcoin, promising an exciting period ahead regardless of noisy price movements heading into the election in two weeks time.

In the broader US economy, the labour market has demonstrated notable resilience in the face of recent natural and industrial disruptions. Initial jobless claims fell to 227,000 last week, despite the challenges posed by Hurricane Milton and an extended strike at aircraft manufacturer, Boeing. Importantly, hurricane-related layoffs in Florida were counterbalanced by declines in jobless claims in other states, highlighting a robust labour environment outside the affected regions. The Federal Reserve’s Beige Book also characterised employment as “stable,” with minimal layoffs reported across various sectors.

In the housing sector, the US market is currently experiencing a divergence. New home sales surged in September, driven by a temporary decline in mortgage rates. Conversely, existing home sales plummeted to their lowest levels since 2010, largely due to the “lock-in effect,” where homeowners with low-rate mortgages are reluctant to sell and face higher rates on new purchases. Affordability remains a significant hurdle for many first-time buyers as prices continue to remain elevated. While the recent rate relief has stimulated new home sales, a sustained recovery in the housing market will depend on broader mortgage rate stabilisation or potential intervention from the Federal Reserve.

Emory University’s recent investment in digital assets marks a shift toward institutional adoption of crypto. The university disclosed holdings in Grayscale Bitcoin Mini Trust and Coinbase shares, totalling approximately $15.9 million, signalling an emerging acceptance of digital assets among traditional institutions.

Microsoft’s upcoming shareholder meeting is set to vote on a proposal to explore Bitcoin as a treasury asset. While the board opposes the proposal, citing volatility and regulatory concerns, even a minor allocation from Microsoft’s $76 billion cash reserves would have a profound impact on legitimising BTC as a corporate asset.