Investors Lose Confidence in US Dollar. Forecast as of 18.04.2025

As a rule, one must pay an entry fee to gain access to an exclusive and privileged club. This perspective reflects President Trump’s understanding of the US market. However, investors have a different standpoint. There is a growing perception of confidence issues with the US dollar. Let’s discuss this topic and make a trading plan for the EURUSD pair.

The article covers the following subjects:

Major Takeaways

- The ECB has cut rates for the seventh time in the cycle.

- Donald Trump has found a scapegoat.

- Confidence in the US dollar has eroded.

- Long trades on the EURUSD pair can be opened at 1.129, 1.117, and 1.144.

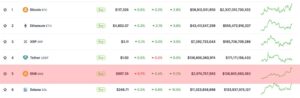

Weekly US Dollar Fundamental Forecast

What measures can be taken to prevent a trade war? First of all, one should avoid engaging in a defensive response. US President Donald Trump has personally imposed the tariffs, granted a 90-day relief, and has the authority to repeal the levies. He characterizes the US as a premium destination that requires paid access and asserts that tariffs will enhance the nation’s economic prosperity. However, the US economy is already strong, and a loss of confidence in the dollar could have long-lasting negative consequences for the country. The EURUSD pair’s reaction to Trump’s criticism of the Fed further demonstrated this.

According to the US president, the market is experiencing a decline in all sectors except interest rates. Oil and gasoline prices are indeed falling, and the ECB cut the deposit rate for the seventh time in the current cycle of monetary expansion from 2.5% to 2.25%. Donald Trump has expressed profound displeasure with Jerome Powell, conveying this sentiment directly, and if necessary, will readily oust him from his role as Fed chairman. According to the Wall Street Journal, the US administration has been discussing the resignation of the central bank chief for months.

Inflation Expectations in US, UK, and EU

Source: Wall Street Journal.

However, the ECB has reduced rates by 175 basis points since the beginning of the cycle, whereas the Fed has decreased rates by only 100 basis points. This is due to the weaker state of the European economy compared to the US economy. In light of this, it is crucial for the Federal Reserve to act swiftly to prevent inflation from becoming entrenched at elevated levels, particularly in the context of ongoing trade tensions. The European Central Bank, for its part, has acknowledged the transitory nature of price surges within the eurozone, which are attributed to US tariffs.

Each financial regulator is performing its duties in accordance with their mandates, and the markets have not yet demonstrated any significant reaction to the US president’s recent comments regarding the Fed chairman. However, if Donald Trump were to sack Jerome Powell, it would severely damage the US dollar. The potential loss of Fed independence, coupled with further aggressive cuts in the federal funds rate, could erode confidence in US assets even further.

According to several investors, many US securities no longer serve as reliable savings vehicles. For instance, the daily fluctuations of Treasury bonds are so significant that they are more akin to a risky asset than a safe haven.

US Treasury Yields and Volatility

Source: Bloomberg.

The capital outflow from the US, driven by a loss of confidence in US assets, suggests that the EURUSD pair is poised to resume its uptrend. A prompt resolution to trade conflicts would be beneficial for bears, although this will require several weeks to several months. It is not yet clear whether Donald Trump will be satisfied with the “Buy American” offers extended by other countries.

Weekly EURUSD Trading Plan

Under these conditions, the main currency pair may test the support level at 1.1335. However, the quotes will likely rebound swiftly. In this scenario, short-term short trades on the EURUSD pair can be closed, and long trades can be considered on a rebound from 1.129 and 1.117. Conversely, if the price tests the resistance at 1.144, one can use this opportunity to initiate additional long trades.

This forecast is based on the analysis of fundamental factors, including official statements from financial institutions and regulators, various geopolitical and economic developments, and statistical data. Historical market data are also considered.

Price chart of EURUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance broker. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2014/65/EU.

According to copyright law, this article is considered intellectual property, which includes a prohibition on copying and distributing it without consent.