Aussie Defends Its V-Shape Recovery. Forecast as of 27.08.2025

Accelerating inflation in Australia allows the RBA to return to a cautious stance. Against the backdrop of the Fed’s intention to cut rates, this paints a bullish outlook for the AUDUSD pair. However, bulls may encounter numerous obstacles. Let’s discuss this topic and make a trading plan.

The article covers the following subjects:

Major Takeaways

- Inflation in Australia has accelerated to 2.8%.

- Markets do not anticipate a cash rate cut until November.

- Loss of confidence in the Fed is weighing on the US dollar.

- The rebound of the AUDUSD pair from 0.644 and 0.637 will give a buy signal.

Weekly Fundamental Forecast for Australian Dollar

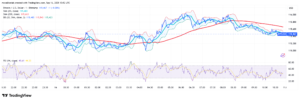

In August, the Australian dollar faced challenges due to the resumption of the RBA’s monetary policy easing cycle, economic challenges in China, and uncertainty regarding the Fed’s readiness to cut interest rates. However, the AUDUSD pair’s recent fluctuations have shown signs of stabilizing.

The Australian dollar rebounded from its two-month low following Jerome Powell’s speech in Jackson Hole. The Fed chief said that the US regulator was ready to resume its cycle of monetary expansion amid a weak labor market to curb tariff-induced inflation. The likelihood of a September cut increased from 69% to 87%, pushing the AUDUSD pair higher.

Central Banks’ Interest Rates

Source: Bloomberg.

Different rates of monetary expansion are a key driver of exchange rate formation in the Forex market. Investors appeared indifferent to the Reserve Bank of Australia’s commitment to maintain its cycle of monetary policy easing in the face of the Fed’s dovish turn. This is particularly relevant given the RBA’s pending final decision. As indicated in the minutes of the previous meeting, future decisions will depend on the incoming data. The regulator is prepared to continue lowering the cash rate only if the labor market remains weak and inflation stabilizes in the middle of the 2%–3% target range.

Unfortunately, anchoring consumer prices has proven to be problematic. In July, the CPI soared from 1.9% to 2.8%, reaching its yearly high. According to Bloomberg, the indicator is expected to reach 2.3%. The average measure of inflation increased from 2.1% to 2.7%.

Australia’s Inflation and Cash Rate

Source: Bloomberg.

As a result, the derivatives market shifted expectations for an RBA key rate cut from September to November. The timing of the next cut was moved from March to May 2026. Australian bond yields rose, and the AUDUSD pair followed suit.

The main driver of the rally in the pair is investors’ loss of confidence in the US dollar amid erosion of trust in the Fed. Bulls are supported by the RBA’s cautious stance and the positive outlook for the Chinese yuan. According to Deutsche Bank, UBS, and Toronto-Dominion Bank, it is capable of strengthening to 7 against the greenback, which will positively affect the Aussie as a proxy currency.

Performance of Chinese Yuan and US Dollar

Source: Bloomberg.

Despite the subdued market response to FOMC member Lisa Cook’s dismissal, the most adverse developments may still lie ahead. Markets do not have a precedent for the Fed becoming an instrument of the US administration, acting on its directives. A precipitous decline in the federal funds rate will likely weaken the US dollar considerably.

Weekly AUDUSD Trading Plan

Under these conditions, the outlook for the AUDUSD pair looks optimistic. A rise in the pair above $0.65 or a rebound from support levels at $0.644 and $0.637 can be used to form long trades.

This forecast is based on the analysis of fundamental factors, including official statements from financial institutions and regulators, various geopolitical and economic developments, and statistical data. Historical market data are also considered.

Price chart of AUDUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance broker. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2014/65/EU.

According to copyright law, this article is considered intellectual property, which includes a prohibition on copying and distributing it without consent.