Bitcoin Dominance Rises For FOMC: Markets Offload MYX, ASTER, and LINEA In De-Risk Move

Is Bitcoin about to steal the spotlight again? As the FOMC meeting looms, investors are fleeing risky altcoins and piling into the king of crypto. Bitcoin dominance just climbed past 59%, its highest level in months, as traders brace for what could be another rate cut in November.

With the crypto market turning cautious, coins like MYX, ASTER, and LINEA are being hammered in what appears to be a textbook de-risking move.

Crypto Fear and Greed Chart

1y

1m

1w

24h

The big question now: is this the calm before a massive altcoin rebound, or the start of another wave of capitulation? With the BTC price steady near $124K and FOMO building across the market, smart money rotations are occurring extremely quickly.

Is Bitcoin Dominance Going to Experience Another Run Amid the FOMC Meeting?

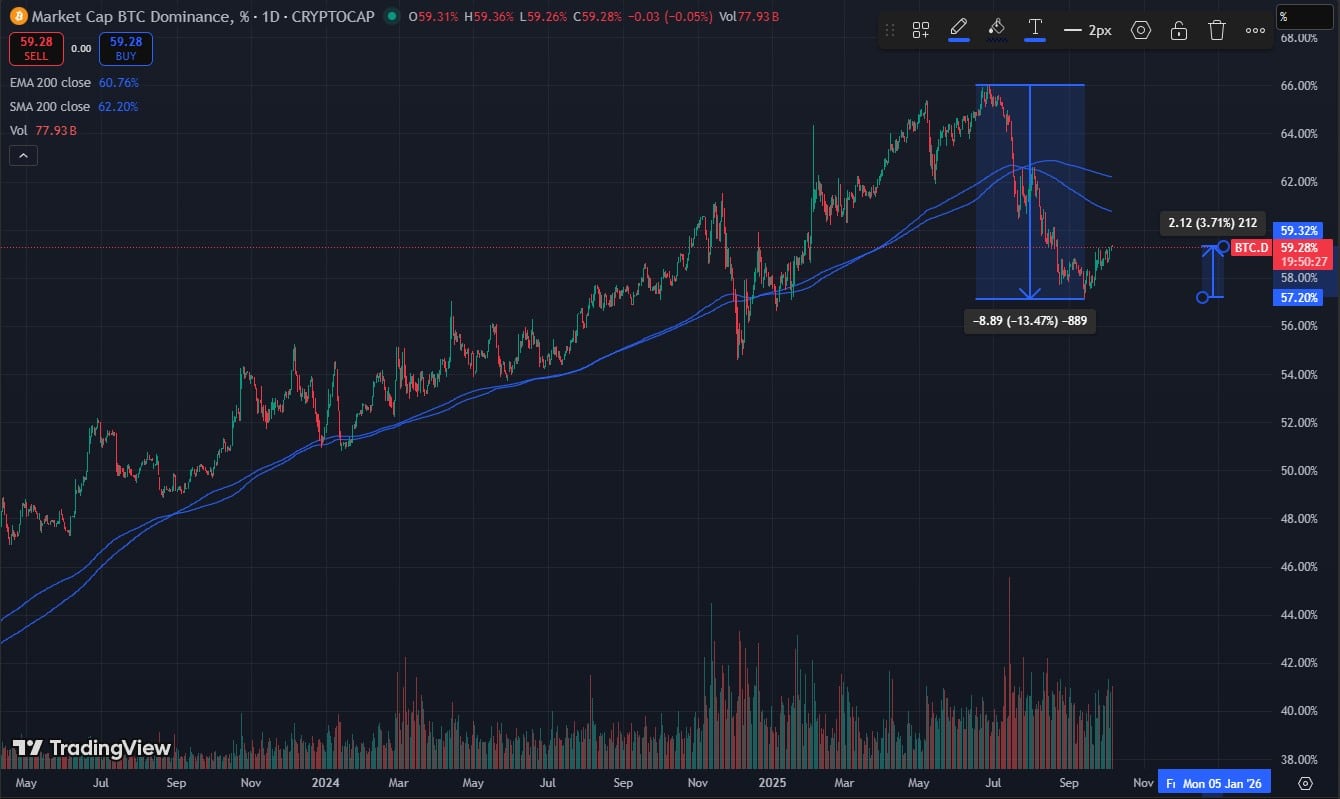

Bitcoin dominance has been one of the most closely watched charts among traders to predict whether an altcoin season is coming or not. Once BTC.D goes up, almost everything else suffers, and this time, the case is not different.

After the breaking of well-respected 200 EMA and SMA levels from 2023, BTC.D dropped 13.3%, giving the altcoin room for growth over the past couple of months. Now, Bitcoin dominance appears to be gaining traction again ahead of the FOMC, rising 3.7% to 59%.

(Source – TradingView)

Currently, the dominance increase preceding the FOMC aligns perfectly with the chart re-testing the 200 EMA and SMA, which are bearish. Once the rate cuts are announced, BTC.D will likely nose-dive. This will result in a mass transfer of cash flow from Bitcoin and stablecoins into altcoins.

These rotations sometimes can happen really fast, and many traders position themselves earlier on speculation, trying to catch the most of those moves. On a weekly time frame, this aligns perfectly with testing the 200 EMA and SMA lines acting as support. Eventually, dominance will bounce from there, leading to another

.cwp-coin-chart svg path {

stroke-width: 0.65 !important;

}

0.86%

Bitcoin

BTC

Price

$123,908.03

0.86% /24h

Volume in 24h

$49.86B

<!–

?

–>

Price 7d

// Make SVG responsive

jQuery(document).ready(function($) {

var svg = $(‘.cwp-graph-container svg’).last();

if (svg.length) {

var originalWidth = svg.attr(‘width’) || ‘160’;

var originalHeight = svg.attr(‘height’) || ’40’;

if (!svg.attr(‘viewBox’)) {

svg.attr(‘viewBox’, ‘0 0 ‘ + originalWidth + ‘ ‘ + originalHeight);

}

svg.removeAttr(‘width’).removeAttr(‘height’);

svg.css({‘width’: ‘100%’, ‘height’: ‘100%’});

svg.attr(‘preserveAspectRatio’, ‘xMidYMid meet’);

}

});

Learn more

rally in the future.

(Source – TradingView)

DISCOVER: 16+ New and Upcoming Binance Listings in 2025

MYX Finance Dropping 69%, Is Recovery Possible?

The MYX chart doesn’t look pretty, with prices retracing almost everything gained in early September.

A combination of explosive profit-taking and pre-FOMC de-risking sends the price tumbling almost back to where it was before the pump.

(Source – TradingView)

In that situation, we can examine the next support level at $2.5. If the price manages to form new support and we see a risk-on bias in the market, we can consider the $9 price level as resistance and a potential reversal of the bearish sentiment for MYX.

DISCOVER: 15+ Upcoming Coinbase Listings to Watch in 2025

Is ASTER Crypto Going Back Above $2.50?

As we talked previously about the Aster price managed to find support at $1.5 region and broke out of the consolidating channel, making a lower high topping at $2.27. Then retraced back to the previous resistance, now support at $1.8 while waiting for the FOMC meeting to pass on.

If we have another rate cut, this means risk is back on, and we can expect to reach a new high and potentially reach a new ATH above $2.5 area. If we get a neutral announcement or negative, we can expect the

.cwp-coin-chart svg path {

stroke-width: 0.65 !important;

}

0.73%

Aster

ASTER

Price

$2.02

0.73% /24h

Volume in 24h

$944.41M

<!–

?

–>

Price 7d

// Make SVG responsive

jQuery(document).ready(function($) {

var svg = $(‘.cwp-graph-container svg’).last();

if (svg.length) {

var originalWidth = svg.attr(‘width’) || ‘160’;

var originalHeight = svg.attr(‘height’) || ’40’;

if (!svg.attr(‘viewBox’)) {

svg.attr(‘viewBox’, ‘0 0 ‘ + originalWidth + ‘ ‘ + originalHeight);

}

svg.removeAttr(‘width’).removeAttr(‘height’);

svg.css({‘width’: ‘100%’, ‘height’: ‘100%’});

svg.attr(‘preserveAspectRatio’, ‘xMidYMid meet’);

}

});

Learn more

price to consolidate above the support for a longer time period or even break down, looking once again for the $1.5 support.

(Source – TradingView)

DISCOVER: 10+ Next Crypto to 100X In 2025

Is Bitcoin Dominance Declining After the FOMC: Will It Help LINEA Reach a New ATH?

Linea is another strong altcoin contender that has been gaining traction recently. There are many speculations that somehow the project will be connected to the airdrop of Metamask coin.

There’s been chatter about a MetaMask rewards leak. Those concepts were early prototypes — not live. But the vision behind them is very real. And it is all about building a token economy.

MetaMask is building the future of personal finance. We’re designing an experience that… https://t.co/ARa6714wOw

— Joseph Lubin (@ethereumJoseph) October 6, 2025

.cwp-coin-chart svg path {

stroke-width: 0.65 !important;

}

0.33%

Linea

LINEA

Price

$0.0274

0.33% /24h

Volume in 24h

$98.45M

<!–

?

–>

Price 7d

// Make SVG responsive

jQuery(document).ready(function($) {

var svg = $(‘.cwp-graph-container svg’).last();

if (svg.length) {

var originalWidth = svg.attr(‘width’) || ‘160’;

var originalHeight = svg.attr(‘height’) || ’40’;

if (!svg.attr(‘viewBox’)) {

svg.attr(‘viewBox’, ‘0 0 ‘ + originalWidth + ‘ ‘ + originalHeight);

}

svg.removeAttr(‘width’).removeAttr(‘height’);

svg.css({‘width’: ‘100%’, ‘height’: ‘100%’});

svg.attr(‘preserveAspectRatio’, ‘xMidYMid meet’);

}

});

Learn more

is currently the best-positioned coin, with many seeing huge potential once the cut rates drop. Currently, LINEA price is consolidating in a huge triangle, poised to explode. If that happens, we will see a breakout of the $0.0285 level, followed by a rally to the previous highs at $0.035.

If that doesn’t happen and the outcome is bearish, we will look for support at the $0.025 price level. Either way, this is going to leave Linea as one of the strongest contenders once altcoin season is back and risk mode is on.

(Source – TradingView)

(Source – TradingView)

DISCOVER: The 12+ Hottest Crypto Presales to Buy Right Now

Join The 99Bitcoins News Discord Here For The Latest Market Updates

Key Takeaways

The post Bitcoin Dominance Rises For FOMC: Markets Offload MYX, ASTER, and LINEA In De-Risk Move appeared first on 99Bitcoins.