Bitcoin vs Gold Safe Haven 2025 – Why BTC is Losing

Gold has surged to a staggering $3,660 per ounce as investors flock to safety amidst the U.S.-China trade war. They’re leaving Bitcoin for gold, so what gives?

Funds are flowing fast into gold ETFs, now commanding $150 billion in assets, leaving Bitcoin ETFs far behind with their comparatively weak $93 billion. It seems that when uncertainty spikes, centuries of trust keep gold ahead of the curve.

BREAKING: CHINA just SOLD 15,000 BITCOIN, opting to instead buy RECORD amounts of GOLD pic.twitter.com/9EFElMN3Fa

— Legitimate Targets (@LegitTargets) April 17, 2025

Bitcoin: The Struggles To Secure Safe Haven Role

Bitcoin’s safe haven story is unraveling. Trading at $85,000, down 20% from its $109,000 January high, BTC has struggled to replicate gold’s resilience during market upheavals.

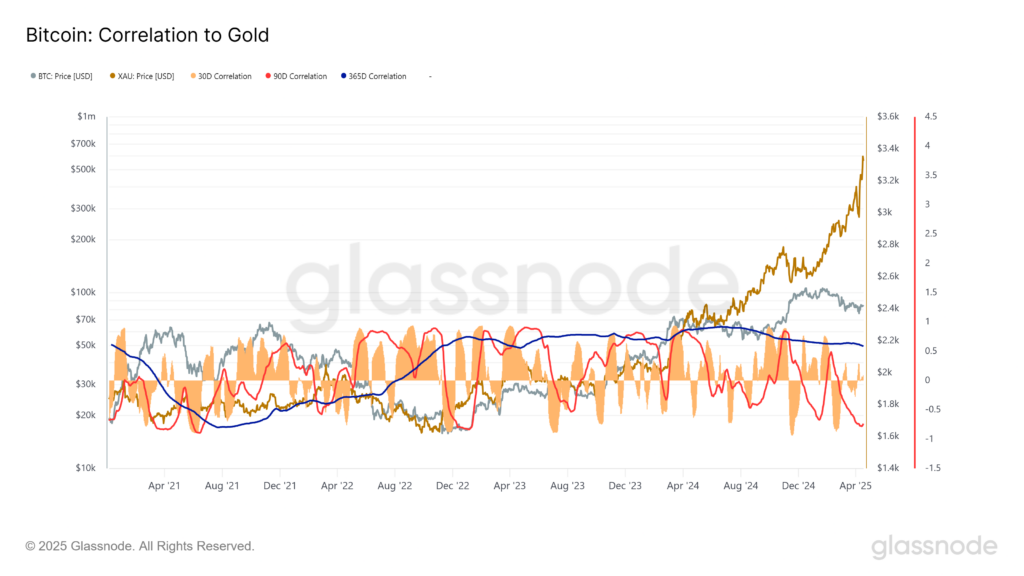

The problem has been Bitcoin’s increasingly tight link to U.S. tech stocks, which drags it away from the traditional flight-to-safety flows flocking to gold.

As JP Morgan wrote in a report this week: “Bitcoin has failed to benefit from the safe haven flows that have been supporting gold in recent months.”

Trump’s trade war with China has turned gold into a lifeboat, while Bitcoin watches from the deck. Tariffs, inflation scares, and broken supply chains have reawakened gold’s dominance, leaving Bitcoin’s status as a safe haven stalled.

Yet many investors believe Bitcoin is just waiting for the right moment. History has shown that when gold rallies, Bitcoin tends to follow harder, but with time.

99Bitcoins analysts predict that Bitcoin could enter a parabolic rise later in 2025, with speculative price targets as high as $200,000.

Lessons from 2025

The BTC vs. gold standoff in 2025 is a litmus test for how investors deal with chaos.

For now gold remains the old standby, trusted and unflinching, while BTC is at a price many won’t pay.

EXPLORE: XRP Price Jumps 11% After SEC Crypto Unit Tease XRP ETF Progress

Join The 99Bitcoins News Discord Here For The Latest Market Updates

Key Takeaways

- Gold has surged to a staggering $3,660 per ounce as investors flock to safety amidst the U.S.-China trade war. They’re leaving BTC for gold, so what gives?

- Bitcoin’s safe haven story is unraveling. Trading at $85,000, down 20% from its $109,000 January high.

- For now, the debate about cryptocurrency’s place in America’s financial future is just beginning.

The post Bitcoin vs Gold Safe Haven 2025 – Why BTC is Losing appeared first on 99Bitcoins.