Cripto Latin Fest: What You May Have Missed

29 Aug Cripto Latin Fest: What You May Have Missed

in Education, Events

This year Bitfinex was the main sponsor at Cripto Latin Fest 2025 in Medellin, Colombia, which took place during Colombia’s Tech Week. Cripto Latin Fest is one of the most important and popular Bitcoin, Web3, and Digital Assets events in Latin America. This year’s event hosted over 5,000 attendees, and facilitated a massive exchange of ideas, networking, and P2P education, discussing the most pressing issues for adoption in Latin America.

Couldn’t Make it to Cripto Latin Fest? Here are the Highlights

Bitfinex was Recognized as “Best Institutional Exchange, LATAM”

In a poll of conference participants, Bitfinex won the award for Best Institutional Exchange in Latin America, recognized for our efforts to provide institutional grade products and services on the Original Bitcoin Exchange.

Fabian Delgado, from our Business Development team was also recognized for his monumental efforts to pave the way for adoption in Latin America. Fabian was awarded “Institutional Crypto Figure of the Year”. We couldn’t be prouder of him!

Bitfinex Business Day brought institutional and professional investors together for an invite only summit!

Cripto Latin Fest officially kicked off on August 20, 2025 with Bitfinex Business Day, an industry summit, attended by builders, experts and thought leaders to discuss business strategy, regulation, the rapidly evolving legal climate, access to institutional liquidity, and tokenisation.

Will Hernandez, of the Bitfinex Business Development team, and Fabian Delgado outlined how resilient infrastructure supports capital access and why LATAM is positioned to grow through digital markets and tokenisation.

Bitfinex Securities also unveiled its inaugural Latin America Market Inclusion Report, demonstrating how tokenisation is the key to unlocking capital market growth in Latin America. Professor and Accountant, Edgar Ricardo Jimenez Mendez joined us in a fireside chat to explain how the true barriers to investment are education and information.

In a panel on adopting digital assets in finance, speakers Diego Osuna, Cristian Guevara, Andres Tobon, and Daniel Marulanda, discussed adoption in Latin America via real cases of banks and fintechs integrating blockchain into services.

While, in the legal panel, regulation was the centrepiece for discussion, as Paula Bermudez, Stephanie Sanchez aka Miss Cripto Lawyer, Daniel Fortin, and Martin Iturri discussed the different regulatory regimes in the region. The takeaway was clear: well-designed regulation does not limit growth, it enables trust and attracts foreign capital.

DAY 1 of Cripto Latin Fest

The official conference began on August 21st, and the energy in the air was palpable. Bitfinex brought insights, community, and business to Medellín. Bitfinex Talks was also on the scene conducting interviews!

Will Hernandez and Fabian Delgado delivered a keynote speech on institutional liquidity.

Crypto Latin fest Day 2

The Bitfinex booth also continued to be a popular attraction, conference-goers were stopping by to learn more about Bitcoin, take AI pictures, and play a trivia game to win prizes.

Jeronimo Ferrer, of the Bitfinex Business Development team, participated in a panel with industry leaders to discuss Bitcoin’s path forward now that it has conquered being a store of value.

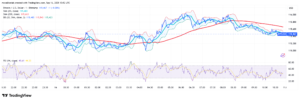

All in all, Crypto Latin Fest 2025 was a tremendous success, and we received an amazingly warm welcome in Medellin, Colombia. Crypto Latin Fest 2025 has demonstrated that Latin America has emerged as one of the most significant regions for cryptocurrency adoption, driven by a mix of economic, social, and technological factors. Persistent inflation, volatile local currencies, and limited access to stable financial services have made digital assets, particularly stablecoins, an attractive alternative for preserving value and facilitating cross-border payments.

At the same time, high remittance flows and underbanked populations create strong demand for accessible, low-cost financial tools powered by crypto. Governments and institutions in the region are increasingly engaging with blockchain technology, exploring regulatory frameworks and tokenisation initiatives that signal growing legitimacy. This combination of grassroots demand and institutional interest positions Latin America as a testing ground for real-world crypto use cases, making it a critical driver of global adoption.