EuroStoxx 50 Snaps Winning Streak. Forecast as of 03.09.2025

A slowdown in capital inflows, worsening prospects for the eurozone economy, and falling corporate earnings have triggered a consolidation phase in the EuroStoxx 50 index. However, bulls are still trying to push the quotes higher. Let’s discuss this topic and make a trading plan.

The article covers the following subjects:

Major Takeaways

- Europe continues to outperform the US.

- The strong euro is hurting European bonds.

- The EuroStoxx 50 corrects against political factors.

- The index can be purchased on a rebound from 5,265, 5,225, and 5,180.

Weekly EuroStoxx 50 Fundamental Forecast

In 2025, the European stock market may surpass the US market for the first time in nearly two decades. However, the EuroStoxx 50 index has snapped its winning streak. In March, the blue-chip index reached an all-time high due to capital flows from the US to Europe, driven by expectations of Donald Trump’s tariffs. Since then, the market has declined sharply, then recovered, and started a prolonged consolidation period. Fiscal concerns have sent European stocks into a correction.

European Stoxx 600 vs. US S&P 500

Source: Bloomberg.

The US dollar’s weakness is the primary factor contributing to the EuroStoxx 50’s outperformance of the S&P 500 in dollar terms. In euro terms, the European index rose 8.4%, while the US index added 9.1%. In the first quarter, American exceptionalism diminished, and the US administration’s tariff policy forced capital to flee to Europe. However, in the second quarter, a significant shift occurred.

Investors quickly recognized that the world was not ready to give up the largest and most liquid stock market. At the same time, the slowdown in the eurozone economy due to tariffs, the deterioration in corporate profits due to the strong euro, and the S&P 500’s record highs kept investors from buying the European blue-chip index.

European Companies’ Earnings and Euro Stoxx Index

Source: Bloomberg.

Concerns regarding EU stocks were intensified by the political crisis in France and apprehensions that the British government might fail to address the budget deficit without hurting GDP growth. As a result, French bond yields reached their highest point since 2008, and British bond yields surged to their highest level since 1998, pushing the EuroStoxx 50 index into a deeper correction.

France-Germany Stock Indices’ Performance

Source: Bloomberg.

However, there are still optimists in the markets. Goldman Sachs anticipates a 2% growth in European stock indices by the end of the year, driven by enhanced economic growth prospects for the currency bloc, conservative fundamental valuations, and the relatively low allocation of European stocks in the portfolios of international investors. The bank notes the growing desire of the latter to diversify their assets amid the S&P 500’s dependence on tech giants.

JP Morgan is also optimistic about the future of the EuroStoxx 50. The company’s assessment is that the loss of momentum in the second quarter appears to be a positive development, given the heightened bullish sentiment that dominated the European stock market in January through March. The autumn season is an opportune time to purchase European stock indices.

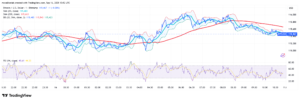

Weekly EuroStoxx 50 Trading Plan

Given the seasonal weakness of the S&P 500 index in September and the dependence of European stocks on the broad US stock index, the EuroStoxx 50 index’s correction after reaching the previously set target of 5,500 is not complete. At the same time, long positions can be considered on a rebound from 5,265, 5,225, and 5,180, allowing you to buy the asset at a lower price.

This forecast is based on the analysis of fundamental factors, including official statements from financial institutions and regulators, various geopolitical and economic developments, and statistical data. Historical market data are also considered.

Price chart of SX5E in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance broker. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2014/65/EU.

According to copyright law, this article is considered intellectual property, which includes a prohibition on copying and distributing it without consent.