Gold Continues to Post Impressive Gains. Forecast as of 16.09.2025

Geopolitical factors, President Donald Trump’s aspirations to reshape global trade, and the decline of the US dollar alongside falling yields on US Treasury bonds are creating tailwinds for the XAUUSD. Let’s discuss this topic and develop a trading plan.

The article covers the following subjects:

Major Takeaways

- Gold ETF holdings have risen by 43% in 2025.

- The precious metal has broken the 1980 record.

- Geopolitical factors are fueling the XAUUSD rally.

- Long positions can be opened with targets of $3,800 and $3,900.

Monthly Fundamental Forecast for Gold

In 2025, gold has shown a particularly impressive performance. It has already set approximately 30 nominal records, and its more than 40% rally is stronger than during most global crises. Notably, two of the three largest monthly inflows into ETFs in at least a decade have occurred this year. The precious metal has surpassed its previous historical high, adjusted for inflation. The setting was January 1980, when prices reached $850 per ounce. However, the subsequent surge in consumer prices hindered the XAUUSD’s ability to keep the same pace, but gold has eventually managed to overcome this roadblock.

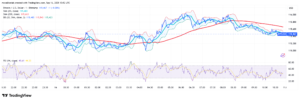

According to Morningstar Direct, gold ETF holdings have grown by 43% since the beginning of the year. In terms of revenue, they have achieved an all-time high. The decline in 10-year bond yields to their lowest level since 2022 and the 11% weakening of the USD index have created favorable conditions for exchange-traded funds.

Global Gold ETF Holdings

Source: Bloomberg.

Gold is rising like there is no tomorrow. During the global economic crisis, its price rose by 31% in 2007, 5.8% in 2008, and 24% in 2009. In the first year of the pandemic, the precious metal rose by 25%. Only in 1979, due to the energy crisis and stagflation, did the asset soar by 140%.

Investment demand is skyrocketing. Retail investors are flocking to ETFs, while central banks are buying bullion. According to several surveys, the share of gold in the structure of gold and foreign exchange reserves has either already exceeded or is about to exceed the share of US Treasury bonds.

Gold and Treasuries Holdings of Foreign Central Banks

Source: Financial Times.

Does this mean that US Treasuries are being disposed of? There is no evidence in the form of rising yields. The main reason is the increase in the value of the precious metal due to prices rising to record highs against the central banks’ insatiable appetite for bullion.

The escalation of geopolitical risks, the return to a bipolar world with a pronounced confrontation between the West and the East, and the growing concern about World War III are accelerating de-dollarization and diversification of central bank reserves in favor of gold. A global armed conflict could indeed lead to the end of the world.

Another argument in favor of buying the XAUUSD is the volatility triggered by the US administration. Donald Trump’s desire to reshape the financial world is resulting in a loss of confidence in the US dollar. If the US leader succeeds in putting the Fed under his thumb, it will be even worse.

Monthly Trading Plan for XAUUSD

Thus, the more than 40% rally in the gold price stems from favorable economic conditions, geopolitical factors, and growing volatility. Gold has not yet revealed its full potential, so long positions formed at $3,400 per ounce and above should be kept open and increased. The targets are $3,800 and $3,900.

This forecast is based on the analysis of fundamental factors, including official statements from financial institutions and regulators, various geopolitical and economic developments, and statistical data. Historical market data are also considered.

Price chart of XAUUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance broker. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2014/65/EU.

According to copyright law, this article is considered intellectual property, which includes a prohibition on copying and distributing it without consent.