Gold prices jump as the US Dollar falls after Trump raises tariffs

- US-China tensions boost demand for Gold.

- Gold prices surge as markets move away from the US Dollar.

- Gold prices test trendline resistance, adding 2% for the day, at the time of writing.

Gold prices are trading positively on Monday, driven by market uncertainty and an increased demand for safe-haven assets.

Market sentiment has turned cautious due to a series of developments, including US President Donald Trump’s intention to double tariffs on steel and aluminium from 25% to 50%. The growing tariff threats and escalating trade tensions have posed a significant risk to risk assets, while a weaker US Dollar has been supportive of Gold prices.

Tensions between the US and China have also intensified, with Beijing pushing back against Trump’s accusations that it violated a trade agreement reached in Geneva.

Gold daily digest: Trump tariffs, US-China trade wars come back in focus

- In his post on Truth Social on Friday, Trump stated:” China, perhaps not surprisingly to some, HAS TOTALLY VIOLATED ITS AGREEMENT WITH US. So much for being Mr. NICE GUY!”

- The Geneva deal had established a 90-day pause on escalating tariffs between the two nations, with the US reducing tariffs on Chinese goods from 145% to 30%, and China lowering tariffs from 125% to 10%. The agreement also included provisions for China to lift restrictions on the export of critical minerals essential to US industries.

- In response to Trump’s accusations, China’s Ministry of Commerce labelled them as “groundless” and asserted that the US had introduced several “discriminatory restrictive measures,” including export control guidelines for AI chips, a sales ban on chip design software, and the revocation of Chinese student visas. China emphasized its commitment to safeguarding its legitimate rights and interests and vowed to take “resolute and forceful measures” if the US continued its actions.

- With the US Dollar under renewed pressure, increased demand for safe havens could see Gold prices continue to receive a positive boost from the shift in sentiment.

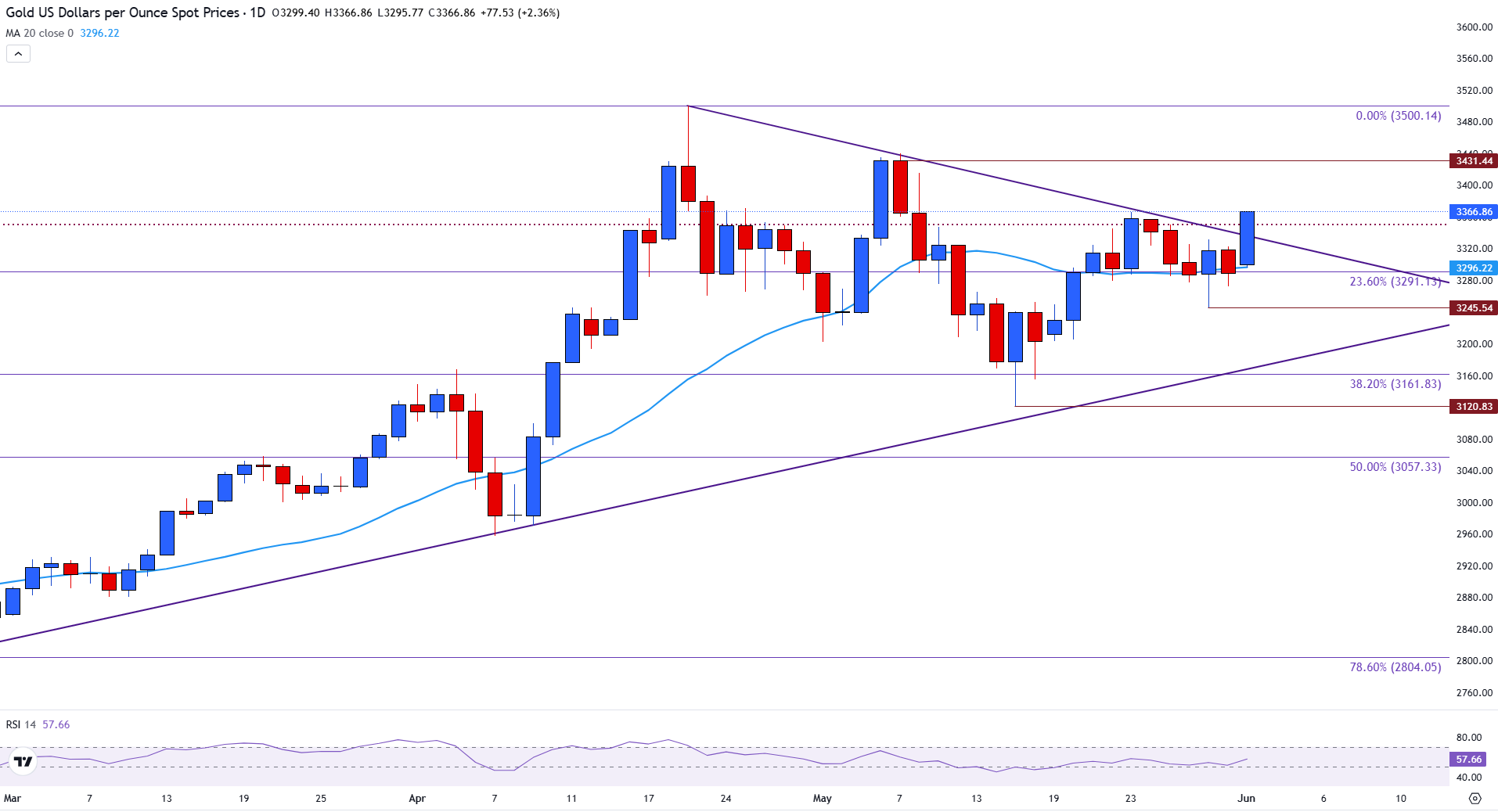

Gold technical analysis: XAU/USD tests trendline resistance

Gold prices are currently testing the upper bound of the symmetrical triangle, providing resistance around the critical psychological level of $3,350.

The 20-day Simple Moving Average (SMA) is holding near $3,295, just below the $3,300 psychological level.

A 2% price increase in today’s session so far has allowed prices to adopt a bullish tone, reflected by an uptick in the Relative Strength Index (RSI), which has risen to 57.

For the next significant move, a clear break of trendline resistance could see prices retest the May high near $3,431, potentially opening the door for a retest of the April 22 all-time high of $3,500.

If prices fail to remain upbeat, a move below $3,300 could see Gold prices move back toward the 23.6% Fibonacci retracement level of the January-April move, near $3,291, and toward the 38.6% Fibonacci level of that same move at $3,161.

Gold daily chart

Risk sentiment FAQs

In the world of financial jargon the two widely used terms “risk-on” and “risk off” refer to the level of risk that investors are willing to stomach during the period referenced. In a “risk-on” market, investors are optimistic about the future and more willing to buy risky assets. In a “risk-off” market investors start to ‘play it safe’ because they are worried about the future, and therefore buy less risky assets that are more certain of bringing a return, even if it is relatively modest.

Typically, during periods of “risk-on”, stock markets will rise, most commodities – except Gold – will also gain in value, since they benefit from a positive growth outlook. The currencies of nations that are heavy commodity exporters strengthen because of increased demand, and Cryptocurrencies rise. In a “risk-off” market, Bonds go up – especially major government Bonds – Gold shines, and safe-haven currencies such as the Japanese Yen, Swiss Franc and US Dollar all benefit.

The Australian Dollar (AUD), the Canadian Dollar (CAD), the New Zealand Dollar (NZD) and minor FX like the Ruble (RUB) and the South African Rand (ZAR), all tend to rise in markets that are “risk-on”. This is because the economies of these currencies are heavily reliant on commodity exports for growth, and commodities tend to rise in price during risk-on periods. This is because investors foresee greater demand for raw materials in the future due to heightened economic activity.

The major currencies that tend to rise during periods of “risk-off” are the US Dollar (USD), the Japanese Yen (JPY) and the Swiss Franc (CHF). The US Dollar, because it is the world’s reserve currency, and because in times of crisis investors buy US government debt, which is seen as safe because the largest economy in the world is unlikely to default. The Yen, from increased demand for Japanese government bonds, because a high proportion are held by domestic investors who are unlikely to dump them – even in a crisis. The Swiss Franc, because strict Swiss banking laws offer investors enhanced capital protection.