Silver Rides Wave of Arbitrage and Spread Trading. Forecast as of 11.09.2025

Due to concerns about the introduction of US tariffs on silver imports, silver bullion is fleeing Europe and moving to the US. This creates a price difference between New York and London and an opportunity for the arbitrage trade. Let’s discuss this topic and make a trading plan for the XAGUSD.

The article covers the following subjects:

Major Takeaways

- The US may impose tariffs on silver.

- Silver stocks on COMEX have reached record levels.

- Trading on the Fed’s independence concerns is buoying XAGUSD quotes.

- Silver can be bought with targets of $42 and $44 per ounce.

Weekly Fundamental Forecast for Silver

In 2025, silver shortages and a favorable backdrop have allowed XAGUSD quotes to gain more than 40% since the beginning of the year. Over the past three years, they have more than doubled. At the same time, trading on the Fed’s independence, the associated weakening of the dollar, and the fall in US Treasury bond yields are creating an ideal environment for silver.

As a rule, silver enjoys volatility. In 2025, volatility stems from the US administration. Washington’s inclusion of silver on the list of critical commodities is keeping investors on edge. In April, Donald Trump ordered an investigation into them, which could result in import duties on silver. This is leading to a capital spillover from Europe to the US and the emergence of premiums between New York and London due to the opportunity to make quick profits from the arbitrage trade.

Premium of Comex Futures over London Spot Prices

Source: Bloomberg.

As a result, silver stocks on COMEX have reached their highest levels since records began in 1992, and short-term lease rates in London have soared above 5% for the fifth time in 2025. There is an insatiable appetite for silver, and ETFs are no exception. The holdings of silver exchange-traded funds continue to surge.

Silver Lease Rates in London

Source: Bloomberg.

The US administration’s role in supporting XAGUSD quotes extends beyond import duties. Donald Trump’s relentless pursuit of lowering the federal funds rate has led to the emergence of a new trading strategy: trading against the news about the Fed’s independence. The US leader has shifted his focus from criticizing Jerome Powell to dismissing Governor Lisa Cook and appointing his people to the FOMC. Donald Trump is confident that he will soon gain a majority, which will force the central bank to comply with his orders.

As a result, the derivatives market anticipates a 150 basis point decline in borrowing costs within 12 months, exerting pressure on the US dollar and Treasury bond yields. Silver is quoted in US currency and does not generate interest income, so the fall in the USD index and Treasury yields is beneficial for the precious metal.

High investment demand amid tariff concerns and the greater attractiveness of silver compared to currencies and debt market assets is leading to limited supplies and boosting a rally in the XAGUSD. Moreover, approximately half of the demand is attributable to the industry, with large AI data centers increasingly introducing solar panels for energy generation.

Weekly Trading Plan for Silver

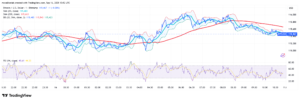

The XAGUSD’s upward trend will likely continue and reach the previously set targets of $42 and $44 due to double support. Long trades can be opened during market dips.

This forecast is based on the analysis of fundamental factors, including official statements from financial institutions and regulators, various geopolitical and economic developments, and statistical data. Historical market data are also considered.

Price chart of XAGUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance broker. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2014/65/EU.

According to copyright law, this article is considered intellectual property, which includes a prohibition on copying and distributing it without consent.