Silver Shines As Key Safe Haven. Forecast as of 24.06.2025

At the beginning of the year, silver was regarded as an underdog, but it has proven resilient and has outperformed expectations. The precious metal has emerged as a competitive alternative to gold, particularly in light of rising geopolitical tensions. Let’s discuss these topics and make a trading plan.

The article covers the following subjects:

Major Takeaways

- Industrial demand for silver remains strong.

- Silver has taken over gold’s role as a safe-haven asset.

- XAGUSD quotes are unlikely to hit new all-time highs.

- Long trades on silver can be considered on a pullback with a target of $39 per ounce.

Monthly Fundamental Forecast for Silver

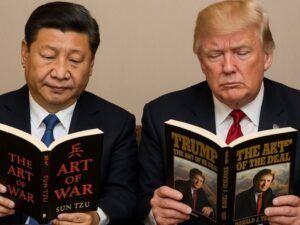

At the beginning of the year, the outlook for silver was rather gloomy. Approximately 80% of the metal’s global demand stems from the industrial and jewelry sectors. Donald Trump’s tariffs and his decision to eliminate financial incentives for renewable energy created concerns for consumers. As expected, XAGUSD quotes plummeted on America’s “Liberating Day. ” However, the situation has evolved considerably since then.

Silver is rapidly closing the gap with gold, which had a successful start in 2025. Over the past month, silver quotes have increased seven percentage points faster than the leader in the precious metals sector. There is speculation in the market that the XAUUSD rally has reached a point of excess and that the asset is overly overbought. Investors are exploring alternative options, turning their attention to the XAGUSD. In light of recent developments, it is worthwhile to consider the potential of silver as a safe-haven asset.

Meanwhile, Donald Trump’s declaration of a two-week postponement for Iran, in conjunction with the Fed’s hesitation to signal any loosening of monetary policy, triggered a decline in gold and other precious metals. The fact that seven FOMC officials no longer anticipate a reduction in the federal funds rate in 2025 was a significant setback for the silver market.

Fed Rate and FOMC Forecasts

Source: Nordea markets.

At the same time, industrial demand, particularly in the solar battery manufacturing sector, has proven to be resilient and stable. Capital inflows into the iShares Silver Trust translated to 11 million ounces. The jewelry industry is experiencing a surge in demand for silver, partly driven by the rising prices of gold. Moreover, a US attack on Iran is likely to increase demand for safe-haven assets.

Current market analysis indicates that XAGUSD prices are unlikely to reach the record high of $48.7 per ounce seen in 1980, which was likely influenced by the actions of the Hunt brothers. When adjusted for inflation, the price would be comparable to today’s $200. In 2011, there was a similar surge to $69 per ounce, adjusted for inflation. However, as in the first case, the precious metal quickly declined from its peak.

Silver Futures Price Performance

Source: Wall Street Journal.

The impact of Donald Trump’s tariffs is not immediate. Therefore, industrial demand for silver may experience a slowdown in the latter half of the year. However, as the US economy weakens, the Fed is more likely to step in to support it. Monetary stimulus is likely to generate a favorable environment for XAGUSD quotes.

Despite the decline in the gold-silver ratio to 93, the indicator remains significantly below its historical averages. Gold continues to exhibit high prices, thereby benefiting all other precious metals.

Monthly Trading Plan for XAGUSD

After reaching the first of two previously established bullish targets at $37 and $39 per ounce, silver saw a pullback. The correction in XAGUSD quotes can be employed to initiate new long positions.

This forecast is based on the analysis of fundamental factors, including official statements from financial institutions and regulators, various geopolitical and economic developments, and statistical data. Historical market data are also considered.

Price chart of XAGUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance broker. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2014/65/EU.

According to copyright law, this article is considered intellectual property, which includes a prohibition on copying and distributing it without consent.