Silver Surges Amid Increased Demand and Elevated Fed Rate Cut Expectations. Forecast as of 01.09.2025

The demand for silver has surged, driven by the Fed’s signals to resume its easing cycle and a recent court ruling that US tariffs are illegal. In this connection, the silver price has surged above $40 per ounce. Let’s discuss this topic and make a trading plan for the XAGUSD.

The article covers the following subjects:

Major Takeaways

- Silver benefits from the weak dollar.

- The Fed’s policymakers are pushing for lower rates.

- The removal of tariffs will boost demand for silver.

- Long positions on the XAGUSD can be considered with the targets of 42 and 44.

Monthly Fundamental Forecast for Silver

Expectations of a Fed rate cut and the Court of Appeals’ repeal of US universal tariffs have created tailwinds for XAGUSD quotes. Silver has managed to exceed the $40 per ounce mark for the first time since 2011, reaching its previously established bullish target. The dual nature of the asset, which is used both as an investment instrument and as an industrial metal, also spurred its quotes.

For seven consecutive months, capital has flown into silver ETFs, marking the longest winning streak since 2020. While silver does not have the same bullish advantage as gold in the form of bullion purchases by central banks, the outperformance of XAGUSD over XAUUSD has the potential to transform the market trends. Saudi Arabia’s investment in iShares Silver Trust and Global X Silver Miners ETF may signal a shift towards alternative assets beyond gold. While its ratio to silver has decreased from its April high of 104, it remains well above the historical average of 50–60.

US Dollar Performance

Source: Bloomberg.

The likelihood of a Fed rate cut and the subsequent weakening of the US dollar drives the demand for precious metals. Silver is quoted in US dollars, so a fall in the USD index is good news for the precious metal.

Notably, Donald Trump’s aspirations to pursue fiscal dominance and radically reshape the FOMC are of significance, as is the Fed’s change in outlook. San Francisco Fed President Mary Daly has pointed to the need to reduce borrowing costs. According to her, the time has come to align rates with the current state of the economy, acting promptly to avoid irreparable damage to the labor market.

US Labor Market Indicators

Source: Bloomberg.

The 75,000 job growth in August, as predicted by Bloomberg experts, will only serve to highlight the current state of economic weakness in the US. Notably, this marks the first instance since 2020 where the figure will increase by less than 100,000 for four consecutive months. The Fed has every reason to resume its monetary expansion cycle, and the XAGUSD has solid ground to surge.

The Court of Appeals’ ruling that Donald Trump’s universal tariffs are illegal is a positive signal for silver. Approximately 50% of the demand for the precious metal is driven by the industrial sector. The elimination of import duties will provide a significant boost to the sector’s recovery. At the same time, Citigroup believes that the market is underestimating the risks of imposing tariffs on silver under Section 232 of the Trade Expansion Act. It is anticipated that this will further strengthen the XAGUSD rally.

Monthly Trading Plan for Silver

The potential of silver has yet to be fully realized. The price will likely increase to between $42 and $44 per ounce due to several factors, including the Federal Reserve’s aggressive monetary expansion, the elimination of universal tariffs, and an elevated risk of import duties on silver. The recommendation is to buy.

This forecast is based on the analysis of fundamental factors, including official statements from financial institutions and regulators, various geopolitical and economic developments, and statistical data. Historical market data are also considered.

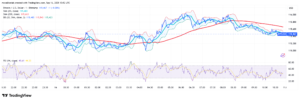

Price chart of XAGUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance broker. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2014/65/EU.

According to copyright law, this article is considered intellectual property, which includes a prohibition on copying and distributing it without consent.