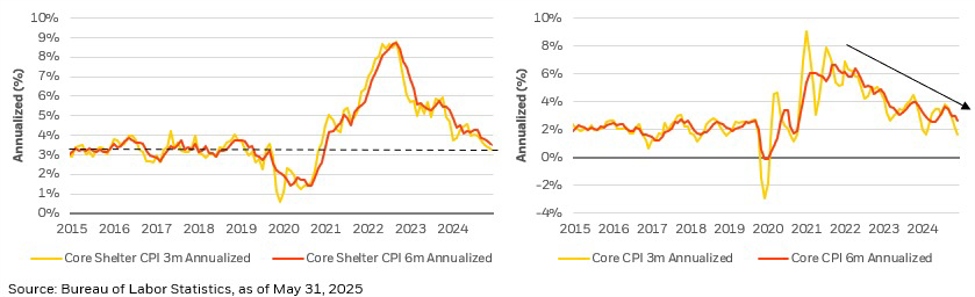

Tame CPI boosts Fed rate cut expectations

Rick Rieder is BlackRock

CIO of Global Fixed Income. He says that with CPI coming in below expectations means “significantly increases the likelihood of Fed cuts this year, particularly if there is material slowing in employment.”

In brief:

US inflation came in softer than expected for the fourth straight month, with both headline and core CPI easing. Core services inflation is now at its lowest 3- and 6-month annualised pace since mid-2021, while shelter inflation has returned to pre-pandemic levels.

Though tariffs remain a potential inflation risk, the combination of subdued price pressures and a cooling—but still solid—labour market strengthens the case for Federal Reserve rate cuts this year, especially if employment slows further.

ICYMI:

ForexLive.com

is evolving into

investingLive.com, a new destination for intelligent market updates and smarter

decision-making for investors and traders alike.