US CPI report the key highlight in the day ahead

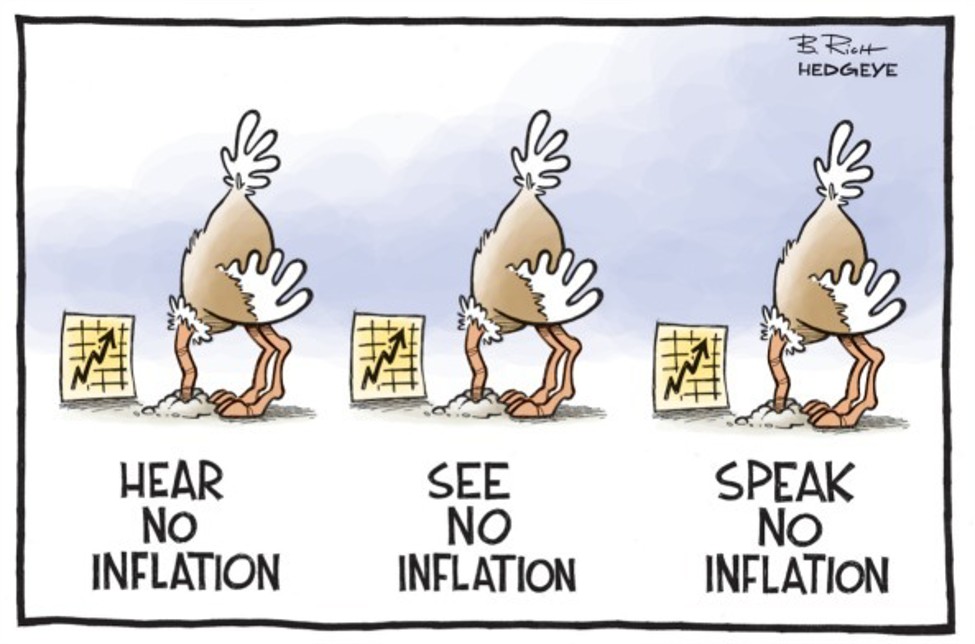

This image always finds a way to come back time and time again. But is it still a bit too early to see price pressures ramp up as a result from Trump’s reciprocal tariffs since April? That will be the interesting thing to look out for in the US CPI report for June today.

First, let’s take a look at the estimates.

- Headline monthly inflation: +0.3% (prior +0.1%)

- Headline annual inflation: +2.7% (prior +2.4%)

- Core monthly inflation: +0.3% (prior +0.1%)

- Core annual inflation: +3.0% (prior +2.8%)

Just be wary though, that there is a risk of undershooting on the core monthly inflation reading. While the “consensus” points to +0.3%, the average points to it being fairly closer to +0.25% in further decimal points. And the forecast distribution shows a sizable potential for a +0.2% reading.

That might create a bit of a distortion if the tariffs impact are yet to materialise. In other words, it creates a false sense of confidence that inflation pressures are holding even as Trump is continuing his tariffs crusade.

Goldman Sachs notes that it is “not too surprising that tariff effects have not

shown up strongly in official consumer prices yet”. Adding that “many tariffs only began to have

an impact around early May” while importers were also allowed to “use automatic

payment transfer system to delay their tariff payments for up to 1.5 months”.

Taking that into the timeline, it means that the real tariffs impact could only show up in the July report. So, that is something to be wary about.

In the meantime though, the report today will be one that markets will use to size up a rate cut in September. But even then, it might still be a bit too early to say. As for a July move, the numbers we’ll be getting are unlikely to move the needle on that.

It is clear that the Fed needs more clarity and with Trump continuing to push deadlines on tariffs – now 1 August instead of 9 July – it is making their job really tough to get a sense of any impact on inflation in the medium-term.

As such, a July move should continue to be ruled out regardless. That despite the likelihood that Trump is going to keep lambasting Powell in the aftermath of the data here and in the month(s) to come.

A downside miss on the inflation numbers might be a false dawn but I reckon it will still be enough to bolster odds of a September rate cut. Currently, that sits at ~62% with traders anticipating ~47 bps of rate cuts by year-end.

The question then would be, will the Fed push back on the market pricing in wanting to wait for the July report next month? That will be a key consideration for markets not to take things too far as we are perhaps yet to see the real impact from tariffs show up.

ForexLive.com

is evolving into

investingLive.com, a new destination for intelligent market updates and smarter

decision-making for investors and traders alike.