What is NFT Minting: Step-By-Step Guide on How to Mint NFTs

If you want to generate profits through non-fungible tokens (NFTs), it is essential to participate in minting. Indeed, it is possible to purchase NFTs and sell them for profit. However, to achieve a truly professional level of expertise, it is essential to master the art of minting.

This article delves into the process of minting NFTs, which involves the creation and registration of non-fungible tokens on a blockchain network. This guide to minting NFTs is designed to address the common challenges encountered by beginners when minting their first NFT. At the conclusion of the article, we will explore the financial strategies employed by collection creators and the increasing trend among crypto traders of leveraging NFTs.

The article covers the following subjects:

Major Takeaways

- Artists and crypto traders mint NFTs to prove the uniqueness and ownership of digital assets, as well as to generate revenue from direct sales and royalty fees.

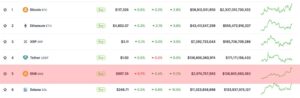

- Selecting a suitable blockchain platform is paramount to successful minting. This could be Ethereum or alternative blockchains such as Polkadot, EOS, Tron, WAX, and Cosmos. Notably, alternative blockchain technologies offer more affordable gas fees.

- A crypto wallet is necessary to create a non-fungible token. The choice between software and hardware wallets depends on striking a balance between convenience and security.

- Special marketplaces are required for selling an NFT. For novice traders, platform fees are a crucial factor. It is better to select a marketplace with the lowest gas fees to minimize minting costs.

- The minting process involves creating a digital piece of art, choosing a blockchain and a crypto wallet, registering on an NFT marketplace, uploading the digital artwork, choosing the sale price and royalties, paying fees, and then promoting it for quick sale.

- If you want to mint an NFT, it is essential to ensure that you are well-versed in the associated terminology and risks. Adherence to the marketplace’s minting guidelines is also crucial to mitigate risks and ensure a seamless process.

- NFTs can be used to establish ownership rights and receive license payments, become the owner of assets in emerging metaverses, and even obtain a loan using NFTs as collateral.

How does NFT Minting Work?

NFT minting is the process of creating a non-fungible token through which digital artworks are transformed into unique assets. These artworks can take various forms, including images, videos, audio, or even domain names.

Imagine a talented artist creating outstanding digital artwork. It is essential to verify the uniqueness and ownership of these digital creations. This is where NFT minting becomes a valuable solution.

The NFT minting process begins with the creation of a unique digital work. The NFT creator then uploads the file to a specialized NFT platform that runs on popular blockchains such as Ethereum or Binance Smart Chain.

Once a platform has been selected, a creator can initiate the minting process, implying that the data about a digital asset is recorded based on blockchain technology. The result is a unique token that stores the record of ownership of this digital asset. Each NFT token is unique and cannot be replaced by another token. Therefore, a “non-fungible token” refers to the unique digital assets, each one being one-of-a-kind, that are secured by blockchain technology.

In addition, NFT smart contracts play an important role in minting. These contracts contain all information about the token, including its metadata, quantity, and transfer methods, and automatically execute and control all conditions described in the code. An NFT smart contract is a digital agreement that ensures the transparency and security of transactions with digital assets. Following the successful minting of an NFT token, it becomes available for trading and storage on NFT marketplaces.

Considerations Before Minting an NFT

Generally speaking, the process of minting NFTs appears straightforward. However, as soon as the idea is put into practice, NFT project creators inevitably encounter nuances that require careful consideration in advance.

Choosing a Blockchain

A blockchain platform is a cornerstone of the NFT space, determining its operational framework. You can select the most widely used Ethereum blockchain or turn to equally efficient alternatives. Some examples of these blockchains include Solana, Polygon, Binance Smart Chain (BSC), and TON.

In the NFT space, novice creators most often choose alternative blockchains. Ethereum offers robust security and a comprehensive suite of options for creating, hosting, buying, and selling NFTs. However, its high minting costs are not consistently justified. As a result, alternative blockchains are rapidly emerging to rival Ethereum in terms of core capabilities as they gain popularity.

Choosing a Crypto Wallet

Minting NFTs requires a crypto wallet to pay gas fees. Your NFT wallet must provide private keys that allow you to access funds.

When creating an NFT wallet, you should choose between security and convenience. Software crypto wallets offer a more efficient solution for paying gas fees by providing direct access to decentralized applications (dApps). However, hardware crypto wallets are superior in terms of security. These wallets provide maximum security for your funds if all instructions are followed.

Among software or hot wallets, Metamask and Trust Wallet are the most popular. In the hardware wallet market, Ledger and Trezor are the dominant brands.

Regardless of which wallet you choose, it is essential to ensure that there is enough cryptocurrency of the blockchain on which minting will take place in your wallet prior to minting your first NFT. You can transfer cryptocurrency from another wallet, use a P2P service or a swap exchange to buy cryptocurrency, or use the services of centralized exchanges.

NFT Gas Fees

Evaluate prices across various platforms to choose the optimal option for your non-fungible tokens. If you are an up-and-coming artist and are uncertain about the appeal of your digital creations to potential buyers in the NFT marketplace, it may be better to refrain from investing large sums in minting your NFTs on the Ethereum blockchain. In such cases, you can opt for a more cost-effective alternative to mitigate expenses in the event of low demand for your creations. For instance, the commission for minting an NFT on the Solana blockchain is approximately $0.01 or less. On prominent blockchains like Polygon and BSC, the gas fee may amount to several dozen cents.

NFT Trading Platform

Once you have created your NFT, it should be listed on an NFT marketplace to become available for purchase. This is particularly challenging if the Ethereum blockchain has been selected, as it is used by numerous marketplaces within the NFT market.

If you decide to create an NFT on an alternative blockchain, it is essential to exercise greater caution when selecting an NFT marketplace. Ensure that the platform attracts sufficient users to facilitate the exchange of NFTs between sellers and buyers.

For several years, OpenSea has been the leading marketplace. This platform is compatible with both Ethereum and most other prominent blockchains.

Security

Before you mint the NFT, make sure you understand all the terms and associated risks. The cryptocurrency sector is not yet fully regulated, and it is rife with scammers and fraudsters. You should exercise caution when engaging with suspicious individuals or offers, refrain from signing transactions without thorough verification, and maintain extreme caution when downloading electronic documents and files. The internet harbors numerous viruses capable of infiltrating your cryptocurrency wallets and stealing your access keys.

If you have experience with Web3 projects, you will find minting without additional costs to be a beneficial feature. Otherwise, carefully read the NFT minting guide, which describes all the basic steps.

Step-by-Step Guide to Minting NFTs

Now that you have learned the basics, it is time to explore the process of NFT minting. At first glance, creating non-fungible tokens may seem too complicated. By following this step-by-step guide, you will be able to mint your NFTs without experiencing any difficulties and list your NFT for sale on a marketplace.

-

Think through your NFT idea. Before you mint your first NFT, think about the purpose of your creation and what value it will bring to its owner.

-

Create a digital asset. This can be any content, such as an image, music, or other artwork that has some value.

-

Choose a blockchain. Analyze the capabilities of different blockchains, their popularity, and compare gas fees.

-

Create a crypto wallet. Decide whether you want to use a more convenient software wallet or a more secure hardware wallet. Select a specific platform and ensure that the selected wallet supports the blockchain you need. Then, connect your wallet to the platform.

-

Set aside funds to pay fees. If you already have cryptocurrency, transfer the required amount of coins to your NFT minting wallet or purchase coins on a crypto exchange with fiat money.

-

Create an account on an NFT marketplace. Analyze popular trading platforms that support your blockchain and choose the most convenient one. Register an account and link your crypto wallet to it.

-

Mint your NFT. On the marketplace, find the option to mint a non-fungible token, upload your digital art to the platform, and specify the metadata. Then, select how you want to sell your NFT: at a fixed price or through an auction. Some platforms also allow you to sell NFTs with a royalty option, which is a percentage of sales from each purchase of your NFT. Continue creating your NFT according to the marketplace’s instructions. In the final step, confirm the transaction and pay the gas fee.

-

Sell your NFTs. Set the purchase price of the NFT and follow the platform’s instructions to offer your crypto asset for sale.

-

Promote your digital file. It is not enough to create an NFT and wait for buyers. To make a profit faster, you need to get buyers to notice your work. That is why minting also includes promoting your artwork in digital galleries, social media, and other available platforms.

How Long Does It Take to Mint an NFT?

The process can take anywhere from a few minutes to several hours. If you understand how to create an NFT and its metadata, navigate the marketplace, and upload a small digital file, then you will likely get your token done in some 10–15 minutes.

However, it may take some time for novice users to become acquainted with all the ins and outs of the NFT marketplace and complete all the steps. Moreover, minting speed depends on the time the platform takes to process and create an NFT token. For this reason, some marketplaces offer a priority NFT launch service for an additional fee.

However, if you are new to the NFT market and lack the expertise to assess the sales prospects accurately, it would be better to refrain from this option, as additional expenses for the sake of a quick NFT release are often not justified.

Benefits of Minting NFTs

If you are still unsure whether to mint an NFT, let me tell you about the advantages of this method of distributing digital artworks:

- Monetizing creativity. Many novice creators find it challenging to monetize their artworks and content. It is unlikely that a reputable gallery will exhibit your work if your reputation is not widely known. In addition, selling on digital platforms requires a substantial investment in advertising. However, minting can help you establish a reputation as an author. This niche is in its early stages of development and is accessible to everyone, from well-known artists to beginners.

- Ownership rights. Minting NFTs is not solely about sales and earnings. When you mint a token, you establish ownership rights to your creations and can always verify their authenticity via blockchain records.

- NFT royalties. Smart contracts are much more reliable than traditional paper contracts. They cannot be forged, altered, or manipulated in any way. Furthermore, they are accessible to everyone. After one direct sale, an NFT owner receives license fees for each subsequent resale of their NFT. The more expensive the assets are resold for, the higher the royalties the creator will receive.

- New opportunities for creativity. NFT minting opens up new creative avenues. For instance, artists can program their creations so that they change over time.

- Loans secured by NFTs. You can select NFTs from among your creations to use as collateral for a loan, thereby ensuring their liquidity without direct sales.

Risks of Minting and Moving an NFT

Let’s discuss the potential risks associated with NFTs:

- Copyright violation. This point is of particular relevance to those who intend to purchase and resell non-fungible tokens. Some sellers mint NFTs based on copyrighted works. When purchasing tokens, there is always a risk of copyright or intellectual property infringement.

- Market volatility. NFTs are a relatively new asset class and are subject to high volatility. It is not uncommon for digital works with little functional or cultural value to be artificially inflated in price to create hype.

- Lack of demand. Competition among NFT collections is fierce, and the value of such an asset is not always obvious to the buyer. There is a huge risk that your NFT will not be in demand in the market or will remain in the shadow of more successful projects.

- Threats of hacking and token theft. Hacker attacks happen every day, and your marketplace account is also susceptible to malicious actors. To ensure the security of your digital assets, it is essential to implement robust security measures for your NFT transactions.

- Imperfect insurance system. NFT insurance is an emerging industry that is not yet able to cover all the risks associated with minting and selling NFTs.

- Legal and regulatory framework. Governments are taking steps to regulate smart contracts more stringently. Therefore, when choosing a platform for your NFT marketplace, it is essential to determine the jurisdiction in which the company is subject to and the regulations it must comply with.

Practical Applications for NFTs

Non-fungible tokens offer a streamlined and transparent approach to confirming authorship and ownership of digital content, while also opening avenues for generating revenue.

In the art industry, NFTs have emerged as a new medium for selling digital works at auction. One of the most successful creators is Beeple. His works are available on OpenSea, and his most expensive piece, titled “Everydays: The First 5000 Days,” sold for $69.3 million.

Another notable example of NFTs that have generated substantial revenue for their creators is the CryptoPunks collection. This work does not exhibit any artistic merit, representing pixel art images. The collection is distinctive in that each of the 10,000 images is original. The authors strategically created hype by offering the first owners the opportunity to acquire NFTs at a significantly reduced cost, with only the gas fee being their primary expense.

As the collection gained popularity, the price began to increase. The most expensive are rare NFTs featuring Alien Punks. There are only nine of them, and the most expensive CryptoPunk #5822 was sold for $22 million. The Punk collection is also available on OpenSea and traded on the Ethereum blockchain. If you have several tens of millions at your disposal, you can purchase an alien punk. This is just a small fraction of the successful examples of practical applications of NFTs.

Furthermore, the functionality of non-fungible tokens extends far beyond that of a mere piece of art. NFTs frequently possess additional functionalities and play an active role in community building, essentially serving as a membership card. Some NFTs grant access to exclusive events and facilitate active participation in the project’s economy or as part of a DeFi protocol. NFTs are an integral component of virtually all Web3 games. In this case, an NFT is not just a visual representation; it is a valuable asset that presents new opportunities for the player.

The music industry has adopted NFTs for the release of tracks and albums, providing fans with exclusive rights and generating revenue from resales. Domain names are also tokenized. Tokens are used to confirm ownership of a domain name.

In virtual worlds like Decentraland, tokens are used to purchase and sell land and buildings, expanding the possibilities of digital ownership. It is challenging to envision the current landscape of metaverses without considering the role of NFTs.

Another promising area is Real World Asset (RWA), a market centered around NFTs. In the realm of RWA, non-fungible tokens grant the right to use or own real assets. The initial pilot projects with RWA NFTs are currently being implemented in the real estate, tourism, manufacturing, industrial, agricultural, and mining industries.

Post-Minting Sale Process and Royalties

The terms of sale are established during the minting of the NFT and its listing on the marketplace. Large platforms such as OpenSea allow users to set a fixed price and royalty percentage.

You will receive royalties every time your token is resold. With each resale, the royalty will be automatically transferred according to the smart contract. For example, you create a token, sell it for 100 Ethereum coins, and set a royalty rate of 10%. In the event that a digital file is purchased in the future for 150 ETH, you will receive 15 ETH in royalties.

In order to promote your creations, you should leverage social media and specialized communities to increase their visibility. Participation in NFT auctions and events can also be beneficial. To ensure consistent royalty payments, it is essential to maintain visibility of your collection, engage in active PR and brand promotion.

Conclusion

NFT minting offers unique opportunities for creators and crypto traders to monetize digital artworks by providing ownership rights and licensing payments through smart contracts. In addition to direct sales of digital creations, token holders can earn income from resales and obtain digital assets in virtual metaverses.

The minting process requires careful selection of a blockchain platform, a crypto wallet, and a trading platform. It is also important to ensure transaction security to safeguard against account loss due to hacking. Understanding these principles, as well as promoting your digital creations on social media and specialized platforms, will allow you to earn a stable income from NFT sales and royalties.

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance broker. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2014/65/EU.

According to copyright law, this article is considered intellectual property, which includes a prohibition on copying and distributing it without consent.