Yen Gains Ground As LDP Coalition Loses Majority. Forecast as of 21.07.2025

Shigeru Ishiba has not resigned as prime minister. The tax cuts promised by the opposition are not expected to take effect immediately. Consequently, the USDJPY rate decreased. Let’s discuss this topic and make a trading plan.

The article covers the following subjects:

Major Takeaways

- The LDP lost its majority in parliament.

- Shigeru Ishiba retained his post.

- Hedge funds started to sell the yen.

- Short positions can be considered if the USDJPY pair falls below 147.65.

Weekly Fundamental Forecast for Yen

In times of rapid global shifts, maintaining a consistent position can be challenging. For the first time since 1955, Japan found itself in a situation where the leader of the Liberal Democratic Party (LDP) would govern without a majority in one of the houses of parliament. The LDP and its coalition partner, the Komeito, did not secure the necessary 50 seats in the upper house. Notably, Donald Trump’s role in this matter cannot be overlooked.

Tokyo remained steadfast in its negotiations with Washington, strategically assessing the impact of potential US concessions on Japanese sentiment. The impact of tariffs is just one component of this broader landscape. The fundamental principle of the Liberal Democratic Party was its role as an independent but loyal agent of the US. The new realities of the US administration’s protectionist policy have become unacceptable to the Japanese people and have undermined confidence in the LDP. Although Shigeru Ishiba has decided to remain in power, the likelihood of his resignation remains high.

Probability that Japanese Prime Minister Resigns

Source: Bloomberg.

The strengthening of the yen in response to the ruling party’s defeat in the elections may seem counterintuitive. However, this is an inherent feature of market mechanisms. The USDJPY rate rose in response to rumors, but as soon as the results of the parliamentary elections were announced, it began to decline. In addition, investors were bracing for the most pessimistic scenario: the resignation of Shigeru Ishiba. This did not occur, creating an opportunity to purchase the yen. The results of the vote took the markets by surprise, and the yen has acted as a safe-haven asset, typically increasing in response to elevated uncertainty.

Investors acknowledged that the tax cuts promised by the opposition would not be implemented in the near future. The implementation of fiscal stimulus measures in Japan would have resulted in an increase in Japanese bond yields, which could have posed significant challenges for USDJPY bears.

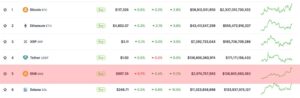

Notably, the “buy the rumor, sell the news” principle is clearly reflected in speculative positions on the yen. Hedge funds have adopted a net bearish position on the yen for the first time in four months.

Speculative Positions on Japanese Yen

Source: Bloomberg.

Will USDJPY bears return to the market? While there have been no remarkable developments, the situation remains relatively stable. Shigeru Ishiba continues to serve as the Prime Minister of Japan, and trade negotiations between the United States and Japan have not advanced. Why shouldn’t the pair resume its downward trend? Conversely, the outcome of the parliamentary elections may limit the Bank of Japan’s room for action. Rather than focusing on trade uncertainty, markets adapt to political uncertainty.

Weekly USDJPY Trading Plan

On paper, this should make the Bank of Japan doubly cautious. There is a strong possibility that the markets will not experience an overnight rate reduction before the close of the year. However, this is not necessary for the downward trend in USDJPY to resume. The Fed’s decision to cut rates is sufficient to affect the market. After reaching the bullish target of 149, the pair is now at risk of falling. At the same time, a breakout of support at 147.65 would create a selling opportunity.

This forecast is based on the analysis of fundamental factors, including official statements from financial institutions and regulators, various geopolitical and economic developments, and statistical data. Historical market data are also considered.

Price chart of USDJPY in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance broker. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2014/65/EU.

According to copyright law, this article is considered intellectual property, which includes a prohibition on copying and distributing it without consent.